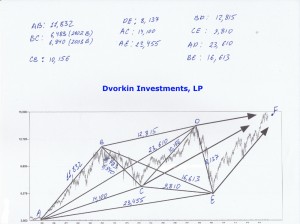

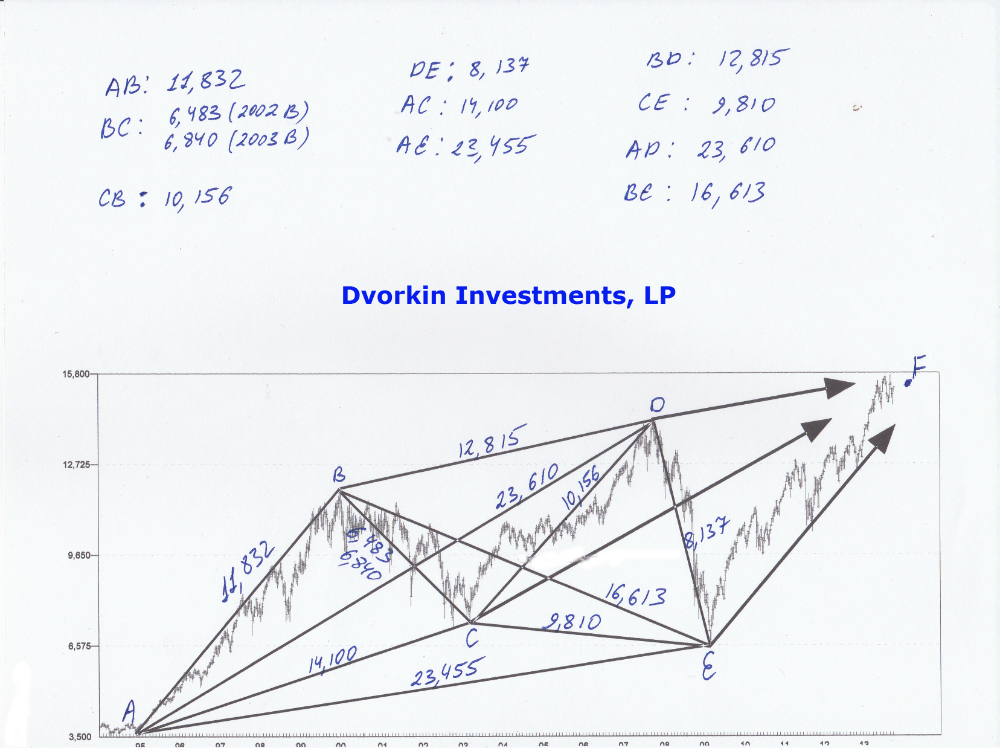

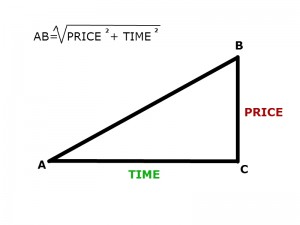

Let’s analyze all of our 3-DV so you can see the amazing accuracy available with this technique. As a quick not, please understand that all 3-DV starting at point A have their origin long before point A was reached. In other words, all 3-DV that we see on the chart above are the direct result of the 3-DV values that have preceded it prior to 1994. Let’s take a more in-depth look.

The value of importance prior to point A was a 3-DV of 9,922. Representing a 3-Dimensional move between 1988 bottom and 1994 top. Let’s take a look at that number and its derivatives to see how many other 3-DV values we can explain.

|

(Original 3-DV 9,922) |

Multiply |

Divide |

|

SQRT 2 |

14,031 |

7,015 |

|

SQRT 3 |

17,185 |

5,728 |

|

SQRT 5 |

22,186 |

4,437 |

|

2X |

19,844 |

4961 |

1. Immediately we see the move AC equal to 14,100 or the square root of 2 move. With only 0.4% variance between forecasted value and real value it is an exact hit. By knowing this number and lattice structure described before you could have identified this turning point 9 years before its actual occurrence. Most certainly you would have been able to identify 2003 bottom by looking at this number at the time.

2. The next two numbers that are associated with the original value of 9,922 are the AE 23,455 and AD 23,610. These values are represented by square root of 5. Even though the variance is a little bit higher, at 5.6%,*** these numbers are once again responsible for exact hits on both the 2007 top and the 2009 bottom. Once the lattice structure is understood these inflection points could have been predicted all the way back in 1994 with exact accuracy. Certainly an analyst studying the market could have identified these points as they would have approached the turning points above.

*** It is important to understand that most of the moves above are exact. The large variance (or perceived variance) of 5.6%, for example, is caused by the growth spiral developing in the stock market. As I have mentioned before the stock market is a natural and dynamic growth system. Meaning not only does it move in a predictable way, but it also grows and changes energy levels as it moves along. For example, the energy level of 1860 or 1920 or 1960 is completely different from the energy level today. This part of analysis might be discussed in future publications for clarification. For now, growth spiral cause for variance will simply be mentioned.

To Be Continued….

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!