Continuation of part 1

Imagine for a second that you are watching the New York Philharmonic Orchestra. As the show starts you see over 50 musicians sitting on stage and playing their musical instruments. The instruments themselves vary across the board. There is a piano, dozens of violins, trombones, cellos, bass, etc… As musicians begin to play, beautiful and harmonious music begins to flood the concert venue. If we stop at this juncture, we would miss an important clue that can help us time the markets with great precision.

As the music plays, a number of very important developments occur behind the scenes. To begin with, music itself is nothing more than a vibration or a wave or a cycle or an oscillation. Each musical instrument and each player produce a range of vibrations while playing their instruments. That creates music. So a single musician will produce a rate of vibration/oscillation that at least in technical terms is identical to the structure of the cycle. Now, having 50 musicians in our orchestra simply means that at any given second there are 50 different cycles (vibrations/waves) being created by 50 different musicians and instruments. They vary across the board and are as diverse as possible.

Yet, they all come together to create beautiful and harmonious music. I cannot stress this enough. All 50 of the cycles (vibrations/waves) unify into 1 primary cycle by the time music reaches your eardrum. No longer are you listening to 50 different vibrations, you are now listening to only one. You are listening to the summation of these vibration, to the final result. Finally, this end product or the summation of all of these cycles could be represented on the chart as a singular wave moving up and down over time.

What does this have to do with the stock market?

If you are to chart the final result or the final musical wave generated by the 50 musicians above it would look identical to the 2-Dimensional chart of any given stock or of the overall chart of the stock market. It wouldn’t be identical, but it would look identical as if the music you have just heard is being tracked by the stock market charting service. This yields an important clue when it comes to the stock market cycle analysis.

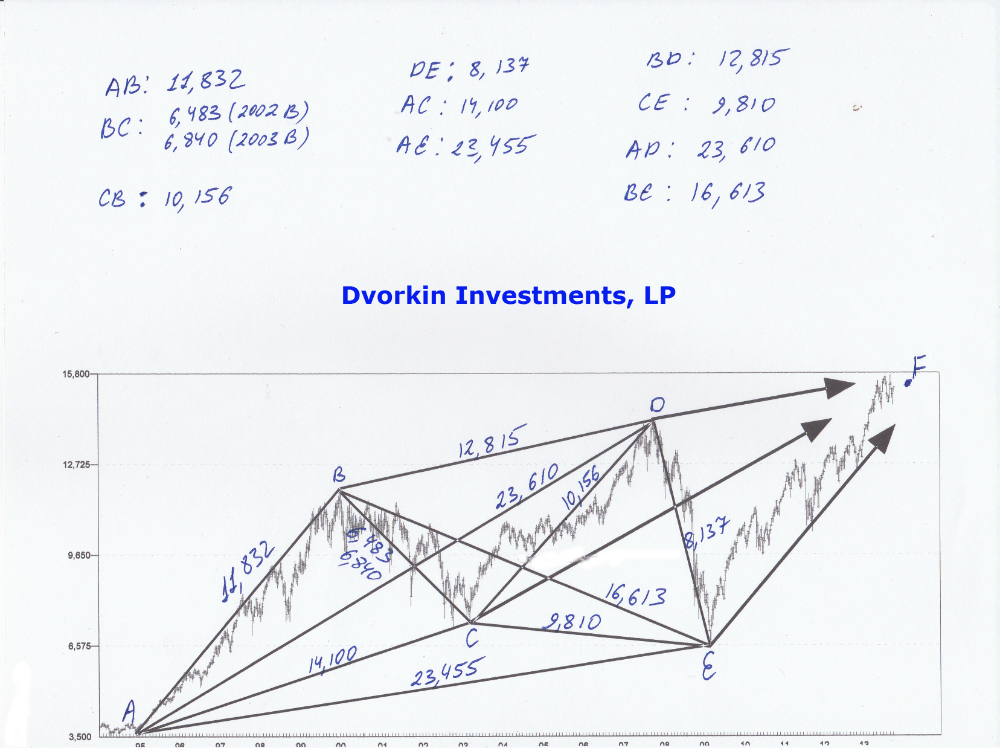

Basically, there are many different cycles working in the stock market at the same time. Their range, structure, power and amplitude are as diverse as you can imagine. While some cycles last for decades and even centuries, others oscillate every few minutes. However, once we identify all of these cycles and put them all together, we end up with an exact representation of the overall stock market. When I say exact, I mean exact.

Let me repeat this. If the cycle structure is fully understood and constructed properly you can build an exact replica of the stock market. Not only for the past, but also for the future. Once the cycles are known you can predict the exact structure of all upcoming stock market moves to the point and to the day. Confirming both the fundamental and 3-DV analysis work described earlier.

To be continued……

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Timing The Market With Cycles (Part 2)