Continuation of part 7

But what if the forecast above is incorrect?

As I have mention so many times before in this book, no analyst or investor should look at any forecast in absolutely certain terms. Until the lattice structure of the market is fully understood, there is always a possibility of being wrong. Unfortunately, understanding the lattice structure of the market is outside the scope of this book. It is too complex and dynamic to be explained in this relatively short book. Volumes of work must be published before clarity could be obtained. Yet, any analyst willing to put in the work, should be able to determine the underlying structure.

For those unwilling to do the work there are a number of available shortcuts. They are….

Shortcut One: 3 Dimensional Space Triangulation.

Earlier in this book I have mentioned that 3-DV exist on multiple time frames. From hourly to yearly to decades to centuries. At any given time there are hundreds of various length 3-DV tracing out market points of force (turning points). What I have found in my research over the years is that major turning points in the stock market or individual stocks are never represented by only one 3-DV. In most cases, such points are represented by a number of different 3-DV coming together at a singular turning point. Once again, these multiple 3-DV can range from hourly to centuries long.

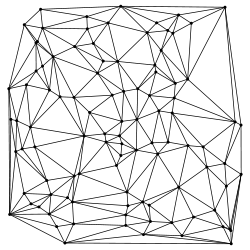

Let me give you an example. As you know, when 3-DV of any length moves in 3-Dimensional space they tend to trace out the circumference of a circle. The radius of a circle represents maximum reach of any given 3-DV. In other words, it represents all possible points on the two dimensional chart where the 3-DV in question can terminate its move.

Further, let’s assume that we are studying five 3-DVs from various points on the stock market chart that have similar termination points. By drawing -OR – calculating their circumferences in either 3-Dimensional space or on 2-Dimensional stock market chart, we will be able to see where those circumferences intersected. As a rule of thumb, if we have multiple intersection at a singular point of time and price, the probability is high that such point will be a major turning point. The probability increases further if the market is heading towards such a point.

In simple terms, triangulation allows us to figure out high probability turning points by identifying at what points multiple 3-DVs come together. By combining this type of analysis with 3-DV lattice structure above we are able to either confirm or increase probability of a turning point.

Let’s take a look at the real stock market example for clarification.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Stock Market And 3-Dimensional Analysis (Part 8)