Do you recall mid to late November of 2023? I do. It was gloom and doom everywhere as quite a few people were predicting an outright collapse. And today, those projections are a distant memory.

So much so that any suggestion of a big scale decline is met with general disbelief. For instance…..

Stock-market pullbacks are price of admission, says strategist who expects bumpy gains

Keith Lerner, chief market strategist at Truist Advisory Services, said it’s normal for markets to pull back — only three years out of the last 40 did not see a pullback of more than 5%.

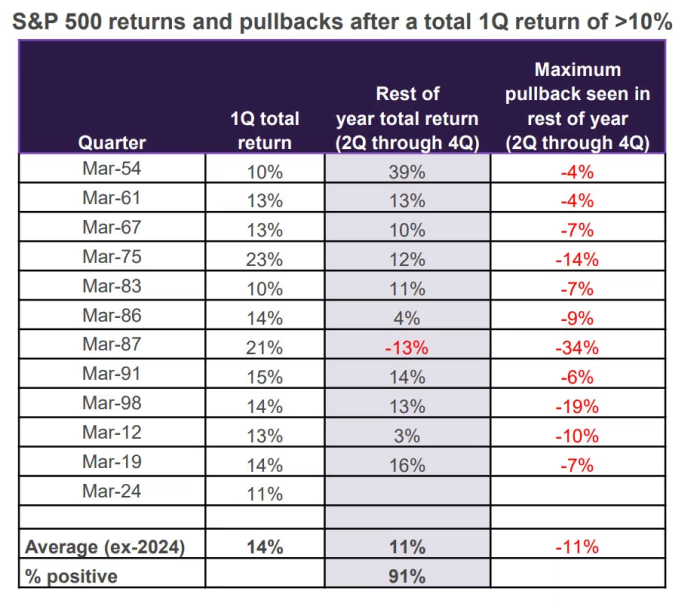

Isolating S&P 500 SPX SPX returns and pullbacks occurring after a first-quarter gain of at least 10%, the strategist found, on average, drawdowns of 11% the rest of the year. All that said, the total return from quarters two through four averaged 11%, with 91% of those instances being positive. (1987 was of course quite the outlier.)

Lerner sees a number of factors supporting stocks, among them that the economy remains resilient. “Our motto for several months now— and the lesson from market history—is a stronger economy with fewer rate cuts is preferable to a weakening economy in need of significant rate cuts,” he said. That resilient economy should support earnings.

In other words, don’t worry, be happy and keep buying. There is nothing to worry about as the market will keep going higher. There is no other possibility.

We don’t necessarily share in this opinion. On the contrary, our work is suggesting something entirely different. If you would like to find out what the stock market will do next, in both price and time, please Click Here. Trust me, you would want to know.