Continuation of part 4.

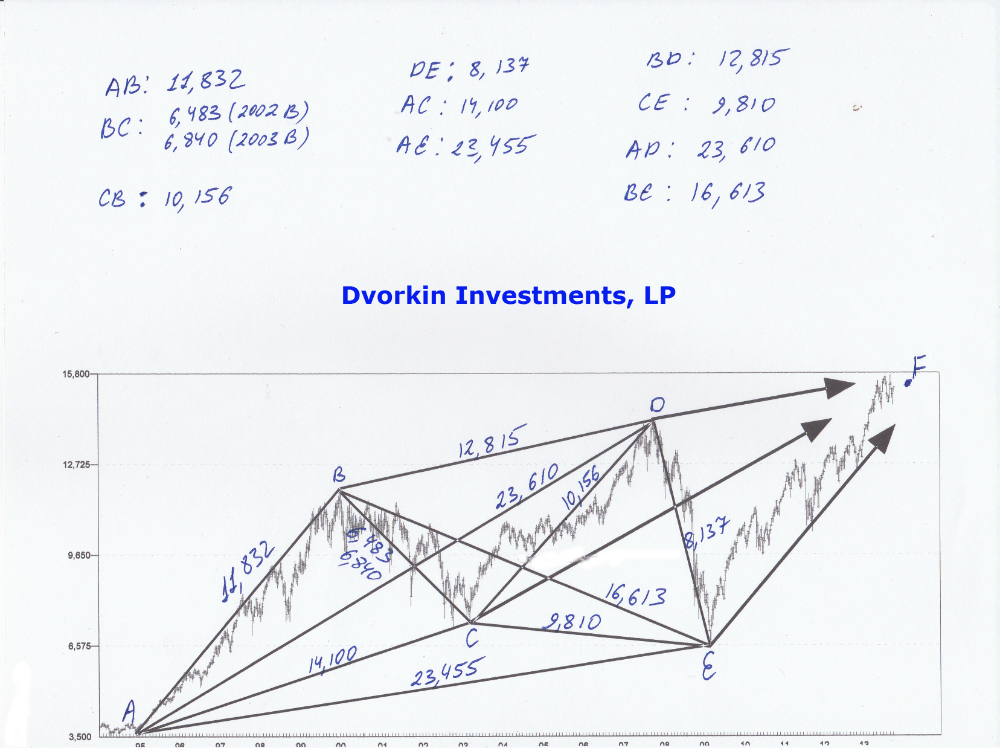

3. We have already mentioned this earlier in the book, but AB + Bc and CD + DE are equal. Let’s take another look. (11,832+6,483 = 18,315) and (10,156 + 8,137 = 18,293). Please note that we are using 2002 actual bottom for point c instead of 2003 secondary bottom. Also note, that the variance is just 22 points over the 15 year period of time. That constitutes a margin of variance equal to just 3 trading days or a few hundred points directional move.

Also, note that if you divide 18,300 by the square root of 5 you get a value of 8,184. Which was the value of the move between 2007 top and 2009 bottom. Further, if you multiply BD of 12,815 by square root of 2 you will get a value of 18,123 which is identical to the value above. Once again, if you know the structure of this move and lattice structure associated with the market you have the ability to identify every single turning point in the market over the last 15 years.

All you have to do at those points is to rotate your portfolio position from long to short and from short to long in order to make a killing and outperform the market by a large margin. It is as simple as that.

4. The move CE of 9,810 and the move CD is the continuation of the move AC represented by 14,100. If you divide 14,100 by the square root of 2 you get a value of 9,970. The actual move between CE ended up being 9,810 giving us the variance of only 1.6%. The actual move between CD ended up being 10,156 giving the variance of only 1.8%. When you combine this knowledge with the previous 3-DV already discussed you get another confirmation that March of 2009 will be a solid bottom for the stock market and that the 2007 top has been reached.

As such, when everyone is freaking out about the 2007-2009 decline and predicting the end of the world as we know it, you would know that the market will turn around in March of 2009 and begin a multiyear rally.

5. When you multiple vale AB of 11,832 by the square root of 2 you end up with a 3-DV value of 16,733. The actual move between 2000 top and 2009 bottom or the move BE was exactly 16,613. That is a variance of just 0.7%. Again, the move AB predicted the move BE and 2009 bottom 9 years in advance. Giving you another confirmation point that March of 2009 is an exact bottom and a major turning point.

6. The move BD of 12,815 was the derivative of the move AB + Bc of 18,315. When you divide 18,315 by the square root of 2 you end up with a 3-DV value of 12,950. This gives us a variance of just 1%.

To Be Continued….

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!