Forbes Writes: Here’s Why The Philippines Economic Miracle Is Really A Bubble In Disguise

The Philippines’ bubble will most likely pop when China’s economic bubble pops and/or as global and local interest rates continue to rise, which are what caused the country’s credit and asset bubble in the first place. The resumption of the U.S. Federal Reserve’s QE taper plans may put pressure on the Philippines’ financial markets in the near future. Another global economic crisis (as I expect) also puts remittances at risk.

As I’ve been saying even before this summer’s EM panic, I expect the ultimate popping of the emerging markets bubble to cause another crisis that is similar to the 1997 Asian Financial Crisis, and there is a strong chance that it will be even worse this time due to the fact that more countries are involved (Latin America, China, and Africa), and because the global economy is in a much weaker state now than it was during the booming late-1990s.

The article above is a MUST read for anyone living in the Philippines. Even though Philippines was the fastest growing economy in the world in the 3rd quarter of this year, the party is about to end. I am sorry to say, but the Philippine economy is about to go through a major decline/contraction/collapse.

I love the Philippines and I wish the economic backdrop was different, but the reality is hard to ignore. The article above is right on the money, providing outstanding reference points and data. Once again, I highly encourage you to read it. Instead of commenting on the points in the article, allow me to introduce the Philippine stock market technical picture into the equation.

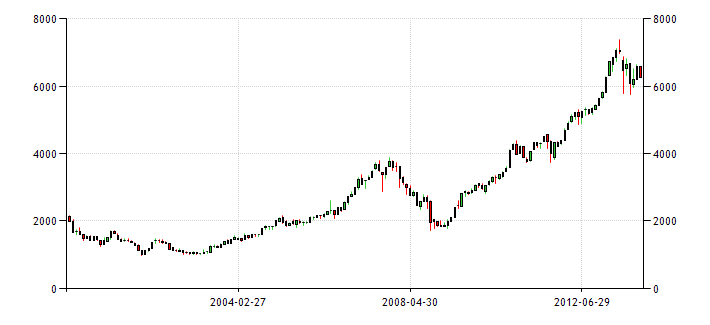

From technical side the market looks very weak. It looks like it is about to break down to the downside. Big time. The market has tried on multiple occasions to go higher, but was unable. A breakdown below 5,500 level would indicate that the bear market in the Philippines in back. The problem is (a huge problem) is that there is no real technical support until it gets to about 2,000. That would be a 66% decline from today’s market prices. In other words, the stock market is predicting a devastating full on economic collapse in the Philippines.

Why do we care about this and what does it have to do with the Philippine economy? The stock market is a leading indicator. As it goes, the economy ALWAYS follows. If we break down below 5,500 level, I would expect the Philippine economy to be in a recession within 6 months. Everything else will follow.

***In reality, this is a worldwide issue. A massive credit bubble is indeed here (driven by the US Fed and unsustainably low interest rates) and it will play a major role in the demise not only of the US Economy, but all emerging markets. Including China. As I have stated on numerous occasions, the US bear market will start in March of 2014.

When it does, anyone and everyone who relies on cheap credit to grow their economies will pay the price. Unfortunately, that includes the Philippines. It is simply unavoidable. Get ready.

P.S. PLEASE DONATE TO TYPHOON HAIYAN VICTIMS HERE

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!