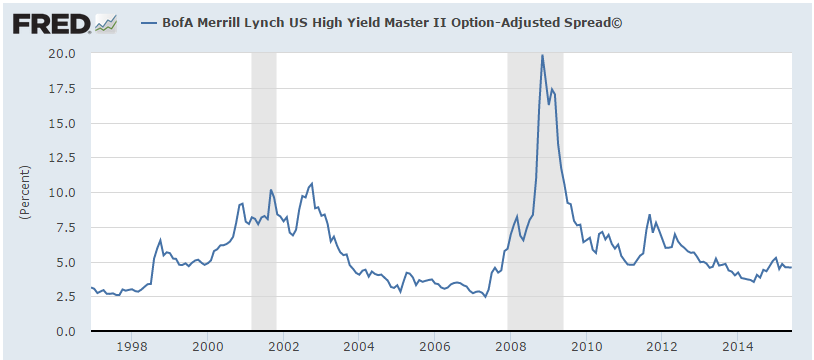

Quite a few people emailed me and asked me to expand a little bit on this post Carl Icahn: A Matter Of Time Before Stocks Implode Particularly, what Mr. Icahn meant by stating that the High Yield spread is probably the best investment opportunity today.

Take a look at the 2007-2009 spike in junk spreads on the chart above. That is what happens when any idiot and even dead people can get a $1 Million mortgage to speculate in the real estate market. A few people, including Carl Icahn, made a huge amount of money from this move.

Today, we have an identical situation. Junk yields should not be this low. Yet, because interest rates are at zero and the FED has flooded everything with liquidity, anyone can get a loan. For instance, corporates who should not be able to get a loan, due to their inability to ever repay, are able to borrow massive amounts of money at 5% or below. That will eventually blow up. Just as it did in 2007-2009.

That is to say, Carl Icahn expects a similar move to what we saw at that time. I would have agree with his assessment. And when it does develop, a leveraged position might lead to massive gains once again. The only question is, WHEN?