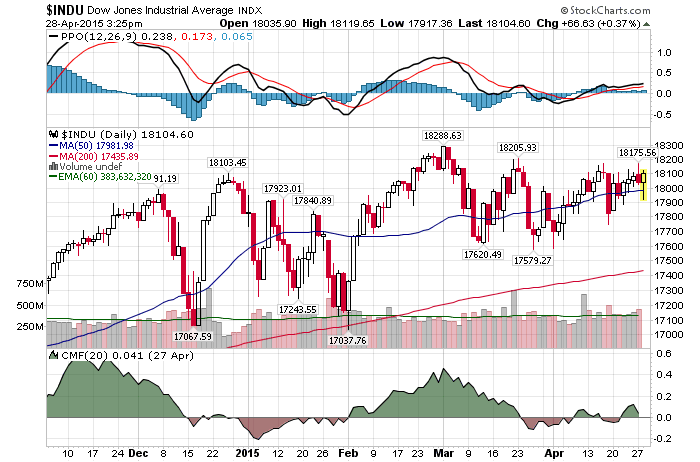

4/28/2015- A mixed day with the Dow Jones up 72 points (+0.40%) and the Nasdaq down 5 points (-0.10%).

So, does it matter what the FED says tomorrow? Not really and not if you value your money. Here is why.

As far as I am concerned there is only one thing, and one thing only, that is holding this market together. The FED and investors blind faith in the fact that the FED will be able to stop any and all market corrections. Either through QE, interest rates or by simply making statements to the press. So much so that every single bottom over the last couple of months can be attributed to the FED talk. El-Erian tends to agree. Danger, Danger — ‘Market Is in Love With Central Bank Trade’

Here are the 3 reasons as to why this “herd mentality trade” will blow up in investors faces. And much sooner than most people believe.

- The Fed is a Reactionary Force: If we study the past, the FED has always been late to react to any and all market developments. For instance, Bernanke was talking about the accelerating US Economy as late as Q1 of 2008. They have no clue and there is no reason to believe that this time will be any different.

- The Market Will Decline Anyway: My mathematical and timing work makes it very clear. Over the short-term the market is independent of all fundamental inputs. That is to say, the market will top out on a certain date in 2015 and initiate its decline. No matter what the FED does or say. That day is approaching fast.

- Investors Will Lose Confidence In The FED: This is unavoidable. As soon as the FED is unable to backstop the next decline, most investors will lose confidence in a millisecond. That in itself will accelerate the decline

The main take away from the points above is as follows. The FED trade will be in place until it is not. The problems is, by the time most investors realize this fact, it will already be too late. By the time the analysis above becomes a reality, the stock market will already be down 10-25%.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 28th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!