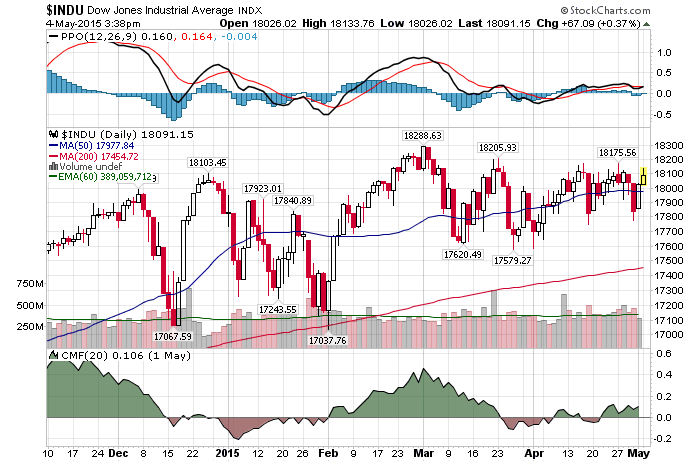

A fairly good technical summary of where the market is today. Of course, the conclusion is bullish, but you shouldn’t expect anything else from the mainstream financial media. By the way, the apparent breakout the guy mentions can be interpreted in a bearish way. As a head fake. In either case, this video is worth 1 minutes of your time.

Bubble Or Not: The Clash Of Hedge Fund Egos

5/4/2015 – A positive day with the Dow Jones up 46 points (0.26%) and the Nasdaq up 11 points (+0.23%).

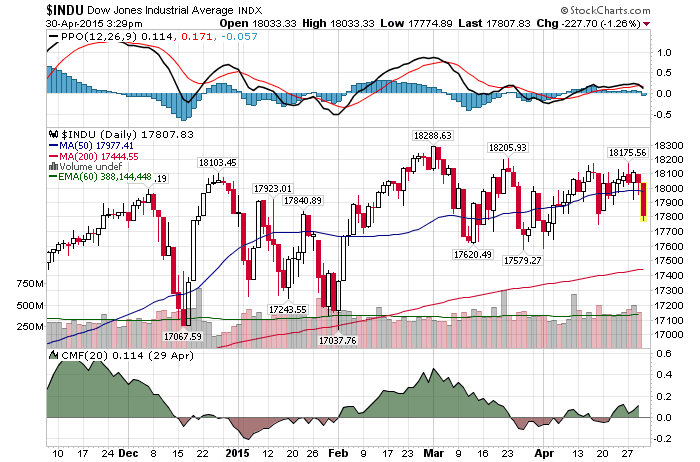

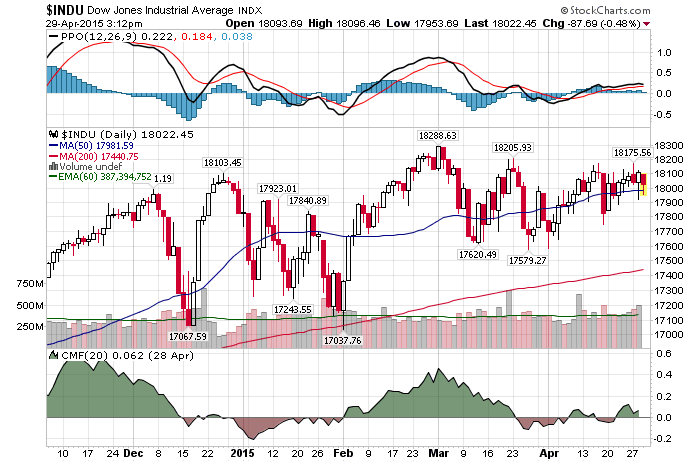

The overall US Equities market continues to trade within a tight trading range. Arguably, since July 17th of 2014. And while most investors remain ovewhelmingly bullish, quite a few mega investors are sounding an alarm bell. Who is right? Let take a closer look

Bullish Case: Third Point’s Dan Loeb

We remain constructive on the US for three reasons: 1) economic data should improve in the next few quarters; 2) the Fed does not seem to be in any rush to move early and a June rate hike seems unlikely; and 3) while investors are focused solely on the first rate raise, we think the overall path higher will be gradual, in contrast to previous rate shifts. These factors should create an environment where growth improves and monetary policy stays flexible, which is generally good for equities (higher multiples notwithstanding). We may follow last year’s playbook and ignore the old adage to “sell in May and go away.

This is probably one of the better bullish cases that I have seen in quite a long time. Simply put, it makes sense.

Bearish Case: Carl Icahn (Icahn: Junk bonds now ‘even more dangerous’ than stock market)

Money keeps pouring into high-yield bond funds, even though that market is “ridiculously high,” Icahn said. “When they start coming down, there is going to be a great run to the exits,” he added. High-yield is the best performer in U.S. fixed-income returns in the year so far. The billionaire activist investor said he’s “very concerned” about the stock market, and he’s hedged in preparation for a correction. Below are a few other nuggets from his appearance on the show.

That is fairly self-explanatory. So, who is right?

I would have to side with Mr. Icahn, but not for the reasons you might think. When we look at the fundamental variables described above (the FED, interest rates, liquidity, earnings, P/E, growth, etc….), they do not really matter. Don’t get me wrong, they do matter, but not when it comes to timing major turns in the stock market.

As my book Timed Value shows, the market traces out an exact mathematical structure as it moves in 4-Dimensional (or higher) space. What does that mean? It simply means that the market will turn around and initiate its sell-off when the TIME & PRICE are right. Not when fundamental data turns. That is to say, my data is not showing anything positive.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 4th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Investment Grin Of The Day

Shocking: Long-Term Stock Market Composition Predicts A Severe Bear Market

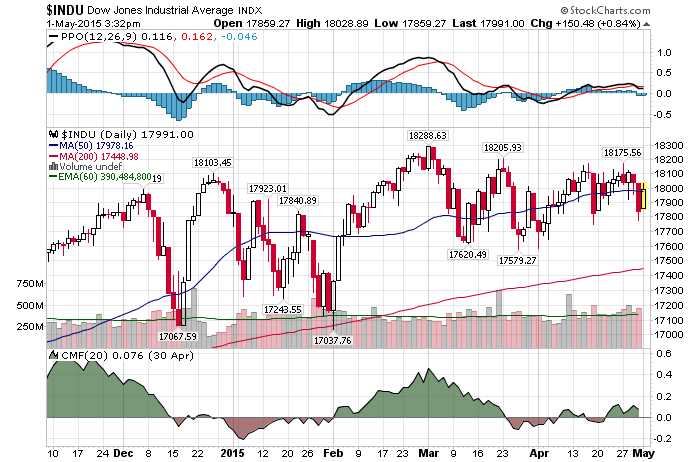

5/1/2015 – A positive day with the Dow Jones up 182 points (+1.02%) and the Nasdaq up 64 points (+1.29%)

5/1/2015 – A positive day with the Dow Jones up 182 points (+1.02%) and the Nasdaq up 64 points (+1.29%)

Below is a comprehensive longer-term review of the stock market and what the next few years hold.

In the early January of 2000, the US Economy wa s booming. The Dow was fast approaching 11,800 and the Nasdaq was a stone throws away from its improbable benchmark of 5,000. Everyone was making a ton of money and as far as most people were concerned, the future looked very bright. So much so, that very few people predicted a bear market of 2000-2002, let alone a secular 2000-2017 bear market that was about to begin.

The only way to do so was to know and to understand the cyclical TIME structure oscillating within the stock market. For instance, an analyst working with such time cycles would know that the stock market’s 17-18 year cycle was topping out in conjunction with the 5 year cycle that started at 1994 bottom. The bull market that started at the bottom in August of 1982 was coming to a conclusion. In fact, it would top out exactly 17.5 years after it had started or on January 14th, 2000 at 11,800. The 5 year cycle that started in December of 1994 would top out at exactly the same time; 5 years and 35 trading days after it had started.

What does this have to do with predicting a severe bear market of 2014/15-2017?

Everything. Based on my work the stock market is a mathematically precise entity. And while there are hundreds of TIME cycles oscillating within the stock market at any one time, I will concentrate on only two to prove my point. The 17-18 cycle and the 5 year cycles. We will look at these cycles over the last 100+ years and I will prove to you, without a shadow of a doubt, they work.

THE 17-18 YEAR CYCLE IN THE STOCK MARKET:

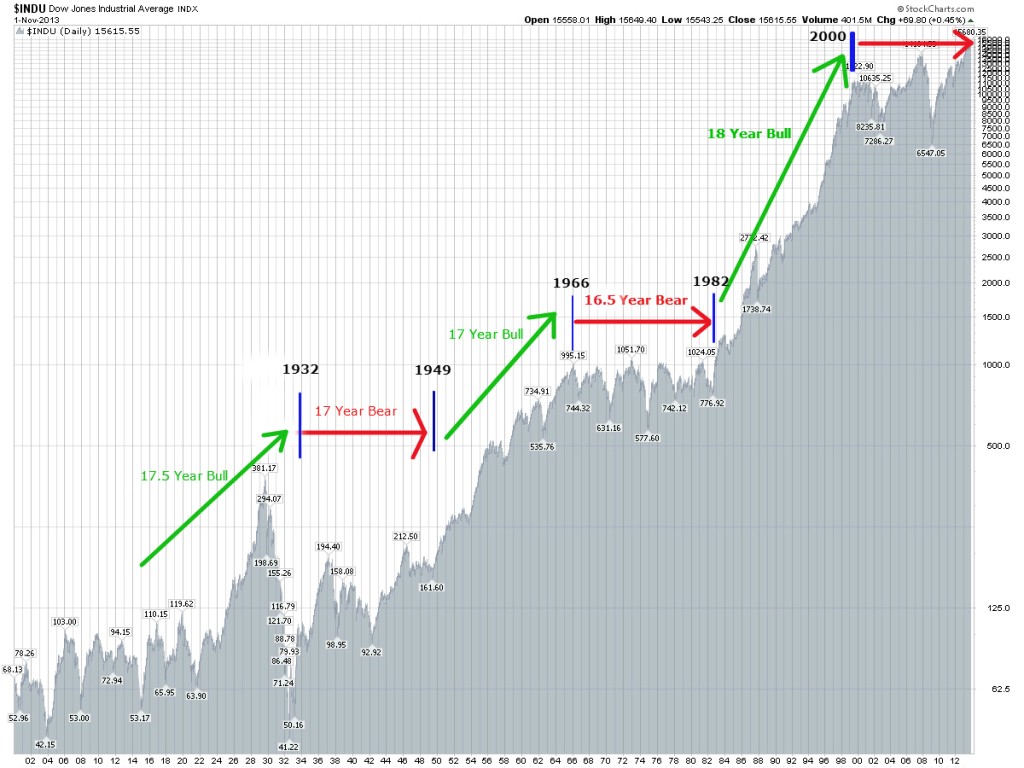

Long-term cycles within the stock market tend to oscillate going all the way back to the first day of trading, in May of 1790. If you would be inclined, I would encourage you to verify that information for yourself. For our purposes we will start our analysis a little bit later or exactly 100 years ago. As the chart above indicates, the stock market tends to oscillate in clearly defined 17-18 year alternating Bull/Bear market cycles.

- 17.5 Year Bull Market (1914 bottom to 1932 bottom): The previous bear market terminated in July of 1914. At that time the US stock market shut down for World War 1. The stock market remained closed between August of 1914 and December of 1914 (a very rare occurrence). When the market finally reopened in December of 1914 it immediately began a rally that would not terminate until October of 1929. Followed by a now famous 1929 stock market crash and a massive 90% 3 year decline. The cycle terminated at the bottom in 1932, completing the 17.5 year bull market cycle at that time.

*Note: It is important to address the 1929-1932 bear market and its impact on the overall 1914-1932 Bull Market cycle. It is a complex matter to discuss without sufficient background or understanding, but the final (short-term) structural composition of this Bull Cycle inverted over the last 3 years (1929-1932). Mostly due to a massive rally between 1924-1929 and a number of down cycles converging on this time period at the same time. Regardless, the overall cycle lasted 17.5 years.

- 17 Year BEAR Market (1932 bottom to 1949 bottom): The cycle originated at the bottom in July of 1932 and lasted until June of 1949. During this period of time we had a post great depression bounce, 1937 crash and World War 2. Yet, despite the overall upward trajectory, this clearly defined 1949 bottom remained 60% below its 1929 top and well below both its 1937 and 1942 tops.

- 17 Year BULL Market (1949 bottom to 1966 top): The market surged higher between 1949 bottom and 1966 top. This was the so called “Golden Age” of post war reconstruction and the American industrial boom. During this time the Dow appreciated over 500% in a clearly defined bull market cycle.

- 16.5 Year BEAR Market (1966 top to 1982 bottom): The market stayed relatively flat during this period of time with a few notable declines of 30-50%. With the 1972-1974 mid cycle decline of 54% being the largest one. This clearly defined bear market completed in August of 1982. Approximately 25% below its 1966 top.

- 17.5 Year BULL Market (1982 bottom to 2000 top): A very well known period and a clearly defined bull market. The market surged higher from its August of 1982 bottom to reach its historic top in January of 2000. During this time the Dow appreciated over 1,400% in one of the strongest bull markets in history.

- 17 Year BEAR Market (2000 top to 2017 bottom): Even though the market is sitting near all time highs (as of this writing in January of 2014) and even though most people have assumed that the new bull market has started, in relative terms the market hasn’t appreciated very much since its top in 2000. The Nasdaq is still down. Plus, with the final down leg of this bear market being ahead of us (based on my mathematical and timing work), the BEAR market of 2000-2017 should complete itself in a negative territory or below its 2000 top.

It is important to note that the small variation (of +/- 1 year) in duration of these cycles is caused by smaller or larger cycles arriving at the same time. As such and based on the cycles above, we are no longer working in an arbitrary fashion when it comes to predicting the stock market. In other words, if the stock market repeats a clearly defined 17-18 year Bull/Bear cycle over a 220 year period of time (since 1790) and does so without interruption, it is safe to assume that the future is predictable and not random.

THE 5 YEAR CYCLE IN THE STOCK MARKET

One other easily identifiable cycle within the stock market is the 5 year cycle. These 5 year cycles represent one completed growth pattern or one completed Bull or Bear cycle. Typically, they tend to appear for 5 years, disappear and then reappear at a certain point in the future. While they are not sequential as the 17-18 year cycle above, once their place within the overall stock market is understood, they show up at exactly the right time. For instance,

- 1914 -1920: Bull Market

- 1924-1929: Bull Market (followed by a 1929 crash)

- 1932-1937: Bull Market (followed by a 1937 crash)

- 1937-1942: Bear Market

- 1966-1971: Bear Market

- 1982-1987: Bull Market (followed by a 1987 crash)

- 1994-2000: Bull Market (followed by a 2000 crash)

- 2002-2007: Bull Market (followed by a 2007 crash)

- 2009-2014: Bull Market

One thing to understand about these 5 Year cycles is that they are exact. They have much lower level variance as compared to their longer counterparts. Essentially, we are NOT talking about 5 years +/- 6 months. We are talking about 5 years +/- a few days. For instance, the 2002-2007cycle started on October 10th, 2002 (at 2002 bottom) and terminated on October 11th, 2007. If you are counting, that is exactly 5 Years and 1 day or scary accurate. I encourage you to study the other cycles outlined above in order to prove to yourself how shockingly accurate they all are.

CONCLUSION:

In summary, predicting a bear market of 2015-2017 is rather simple. All 17-18 year bear cycles end with a 2-3 year bear market. For instance, 1912-1914, 1946-1949 and 1979-1982. And while most believe that the secular bear market ended at 2009 bottom, it is not the case. The secular bear market of 2000-2017 is still in effect and will terminate only when the year 2017 is reached. Although the final price bottom will be higher than the mid-cycle bottom reached in March of 2009.

Further, the 5-Year cycle that started on March 6th, 2009 bottom terminated on July 16th, 2014. Suggesting that the stock market is now ready to initiate its bear leg (despite recent higher highs). When I combine this cyclical analysis with the rest of my mathematical and timing work, the outcome is crystal clear. A severe bear market of 2015-2017 is just around the corner.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 1st, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Shocking: Long-Term Stock Market Composition Predicts A Severe Bear Market Google

Stockman and El-Erian: Get Ready For A Bear Market

As yours truly, David Stockman and Mohamed El-Erian continue to warn their followers that a big stock market decline and a severe recession are coming down the pipeline.

As yours truly, David Stockman and Mohamed El-Erian continue to warn their followers that a big stock market decline and a severe recession are coming down the pipeline.

David Stockman:

- “The worldwide central bank money printing spree of the last two decades has generated massive excess capacity and mal-investment all around the planet.”

- “What is coming, therefore, is not their father’s inflationary spiral, but an unprecedented and epochal global deflation.”

- “So the central banks just keep printing, thereby inflating the asset bubbles worldwide. What ultimately stops today’s new style central bank credit cycle, therefore, is bursting financial bubbles. That has already happened twice this century. A third proof of the case looks to be just around the corner.”

Mohamed El-Erian:

- Financial markets have grown addicted to central bank easing, and that addiction could cause a heap of trouble when central banks tighten the credit spigot.

- “It reminds me a little bit of 2007 and 2008,” when investors tried to discern when the turn would come away from easy credit conditions, El-Erian said. “I’m not so confident that I will see the turn coming, and turns tend to happen quite quickly.”

I couldn’t agree more. The only remaining question is…….are the US Equity markets currently going through a 9 month distribution or consolidation period? If distribution, the time to pay the piper may be soon at hand.

Marc Faber Expects A 60-40% Decline. Is He Insane?

4/30/2015 – A big down day with the Dow Jones down 196 points (-1.09%) and the Nasdaq down 82 points (-1.64%).

The stock market continues to behave as forecasted in our subscriber section. Are we about to bounce to new all time highs -OR- is this sell-off just getting started? Click Here to find out.

Marc Faber has been off of his game over the last few years. So much so that the talking heads within the financial media community now openly laugh at his “Bear Market” forecasts. Now, more bearish than ever, Marc expects a rapid 40-60% decline. Has he gone insane? Let’s take a look.

“For the last two years, I’ve been thinking that U.S. stocks are due for a correction,” Faber said Wednesday on CNBC’s “ Trading Nation .” “But I always say a bubble is a bubble, and if there’s no correction, the market will go up, and one day it will go down, big time.”

My Comment: Oftentimes the best researched bears are too early to the party. I am guilty of the same…..at least I used to be. I remember shorting sub-prime lenders in early 2006 and then wondering how these clearly bankrupt companies can surge higher. By the summer of 2008 they were worth ZERO.

“The market is in a position where it’s not just going to be a 10 percent correction. Maybe it first goes up a bit further, but when it comes, it will be 30 percent or 40 percent minimum!” Faber asserted.

My Comment: Bingo. Most investors have assumed, wrongfully I might add, that we are in a new secular bull market. As a result, everyone believes that every 10-15% correction will be recovered. Nothing to worry about – buy the dips. It will be interesting to watch as a 10% correction turns into a 20%, 30%, etc…..

Faber says low yields and stimulative central bank policies around the world have led to a condition in which “all assets are grossly overvalued … and eventually this will unwind and cause some problems. Look at the market since November of last year to now. The market is up 2 percent. It hasn’t done much, and a lot of stocks are breaking down. I don’t think that the market is in a healthy condition.”

Despite his massively bearish call, Faber said he’s “not short the market yet,” since he doesn’t know how high stocks could go in the interim. Still, he makes clear that “I’m not interested to buy momentum, I’m interested to buy value.”

My Comment: He is absolutely right. Buying now would be a suicide mission. At the same time, Marc is too scared to go short. And not only Marc. Every single bear I know, except yours truly, is scared of this market. Do I smell an opportunity? That’s why it helps to know exactly when the top is due.

In conclusion, NO, Marc Faber is not insane. In fact, he might be the only sane person in this insane asylum we call the stock market.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 10th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Ameritrade CEO Confirms A Bull Trap

This should not come as a surprise to the followers of this blog, most retail investors are fully invested on margin and extremely bullish.

Bad sign? Retail investors all in: TD Ameritrade

A broad look at the 6.5 million customer accounts at TD Ameritrade indicates that retail investors are “pretty fully invested” in stocks, the online brokerage’s CEO said Thursday.

Fred Tomczyk cited several signs of this: margin loans at high levels, client cash at low levels and account holders at the firm logging in frequently. “It’s usually a good indication that people are very engaged in the markets and watching their investments closely,” he said.

So, while there are net capital outflows from the institutional side, retail and corporates (stock buybacks) are fully committed to this “apparent” market rally. Just as they were at 2000 and 2007 tops. Some things never change and most people don’t learn from the past.

Another bull trap is now in place.

The US Economy Nears “Official” Recession As The FED Blames It On The Weather. Who Is Right?

4/29/2015 – A down day with the Dow Jones down 75 points (-0.41%) and the Nasdaq down 32 points (-0.63%)

If you have followed this blog for some time you are very well aware that I have suggested over a year ago that the US economy will continue to decelerate throughout 2014-2015. Until it slips into an official recession. Today’s GDP growth of 0.2% (vs. expected 1%) gives more credence to such a view.

The FED blamed the weather, strong US dollar, energy prices and other transitory factors for this slow down. Fully expecting the US Economy to rebound in the second half of the year. Hence, interest rate hikes are still in play.

Does any of that matter when it comes to our financial markets? YES and NO.

YES. Today’s economic situation is rather easy to understand. At least from my vantage point. The US Economy is running on fumes of zero interest rates and QE #1-3. Nothing more and nothing less. Once this liquidity finally works its way through the system, we will see the US Economy fall back into a recessionary mode. Judging by today’s numbers we are nearly there.

Simply put, there is nothing to drive this economy forward. In fact, I would love to hear what, if anything, will force this economy to grow. That is one of the reasons we are seeing massive corporate stock buybacks and no capital expenditures. Most corporates don’t know what to do with their cash and most don’t have the need to invest in their own business.

NO. It doesn’t matter in terms of the eventual outcome. Whether or not the US Economy falls into a recession, whether or not the FED raises interest rates or introduces another round of QE, one simple truth remains. We are in a massive stock market bubble that will implode sooner or later.

As a result, it is time for investors to stop being mesmerized by the FED. Instead, it is time for them to realize that we are in a bubble that will soon pop. No matter what the FED or the US Economy does.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 29th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

The US Economy Nears “Official” Recession As The FED Blames It On Weather. Who Is Right? Google

Investment Grin Of The Day

Julian Robertson: The Repeat Of 2008 Sell-Off Is Now Highly Probable

Here is a question for you. Who would you rather listen to…..some Charles Schwab yahoo financial adviser who keeps screaming that today’s market is a “buying opportunity of a lifetime” or hedge fund legend Julian Robertson (founder of Tiger Management). I will leave that decision up to you. But if you are wondering, here is what Mr. Robertson thinks.

- Twin bubbles: In bonds and equities.

- The FED is frightened to death.

- It is possible the market will boil over into an explosion. The bigger this bubble gets the bigger the burst will be. The repeat of 2008 sell-off is now a real possibility.

- The FED will raise interest rates….be ready.

- The stock market is in a bubble that will surely pop.

I’ll tell you one thing. It’s nice to be on the same analytical side as Julian.

Julian Robertson: The Repeat Of 2008 Sell-Off Is Now Highly Probable Google