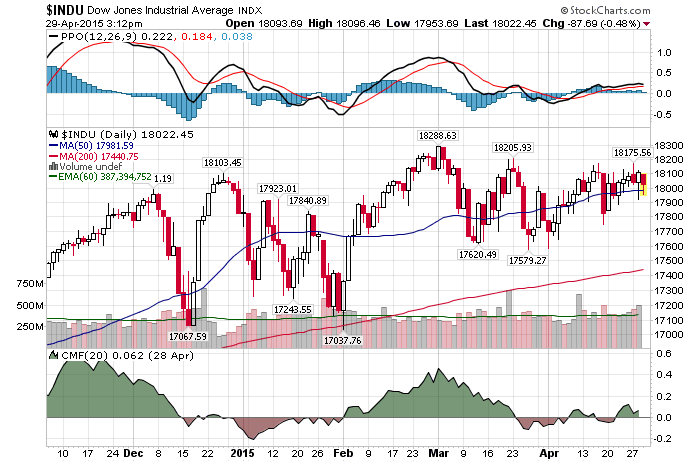

4/29/2015 – A down day with the Dow Jones down 75 points (-0.41%) and the Nasdaq down 32 points (-0.63%)

If you have followed this blog for some time you are very well aware that I have suggested over a year ago that the US economy will continue to decelerate throughout 2014-2015. Until it slips into an official recession. Today’s GDP growth of 0.2% (vs. expected 1%) gives more credence to such a view.

The FED blamed the weather, strong US dollar, energy prices and other transitory factors for this slow down. Fully expecting the US Economy to rebound in the second half of the year. Hence, interest rate hikes are still in play.

Does any of that matter when it comes to our financial markets? YES and NO.

YES. Today’s economic situation is rather easy to understand. At least from my vantage point. The US Economy is running on fumes of zero interest rates and QE #1-3. Nothing more and nothing less. Once this liquidity finally works its way through the system, we will see the US Economy fall back into a recessionary mode. Judging by today’s numbers we are nearly there.

Simply put, there is nothing to drive this economy forward. In fact, I would love to hear what, if anything, will force this economy to grow. That is one of the reasons we are seeing massive corporate stock buybacks and no capital expenditures. Most corporates don’t know what to do with their cash and most don’t have the need to invest in their own business.

NO. It doesn’t matter in terms of the eventual outcome. Whether or not the US Economy falls into a recession, whether or not the FED raises interest rates or introduces another round of QE, one simple truth remains. We are in a massive stock market bubble that will implode sooner or later.

As a result, it is time for investors to stop being mesmerized by the FED. Instead, it is time for them to realize that we are in a bubble that will soon pop. No matter what the FED or the US Economy does.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 29th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

The US Economy Nears “Official” Recession As The FED Blames It On Weather. Who Is Right? Google