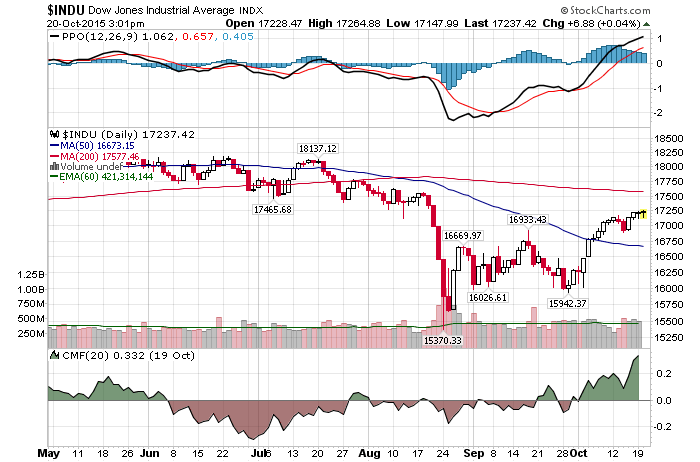

10/20/2015 – A negative day with the Dow Jones down 12 points (-0.07%) and the Nasdaq down 25 points (-0.50%)

As you are very well aware, Q-3 earnings are not off to a good start. A large percentage of corporates are either missing earnings, just as IBM did last night, or guiding lower. In fact, the S&P earnings expectations are down 2% year over year.

Yet, despite all of that, the stock market is slowly grinding its way up. After a massive rally and clearly oblivious to this fundamental conundrum.

But don’t worry, the bulls have a feasible explanation for all of us. Has the market priced in an ‘earnings recession’?

These trends are all far along and are showing reduced efficacy. And the market’s certainly not outright cheap at 17-times the coming year’s projected profits, as the S&P runs up against levels that have thwarted it in the past. Maybe if we all worry real hard about all this a while longer, the market can make its peace with such concerns and move on.

There a number of problems with their thesis. First, they somehow assume that this is a mid-cycle earnings recession that will last only one quarter. Right!!! On the contrary, I believe this is a “we went all in and maxed out all of our credit cards with QE and Zero Interest rates” kind of a earnings recession.

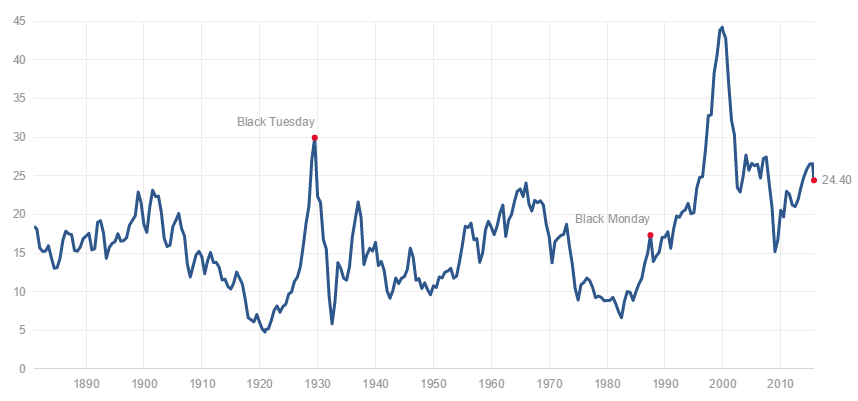

Second, I would be inclined to agree with them if today’s S&P P/E ration was, umm….let’s say, below 10. However, the chart below speaks for itself.

You are probably sick and tired of me saying this, but what can I do, we are selling at the 3rd highest valuation level in history. Right behind 1929 and 2000 tops. And on par with 2007 top.

Fine, let’s assume that this is, indeed, a temporary earnings recession and the US Economy will surge higher next year and the year after that, etc… Even with that, today’s valuation levels and historical data suggest that the stock market will stay flat to down over the next few years. If not decades. And that is the best case scenario.

Yet, if this is not a temporary earnings recession, as my mathematical work suggests, and earnings will accelerate down over the next few years…….OH, BOY……it doesn’t look good for the overall market.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. October 20th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!