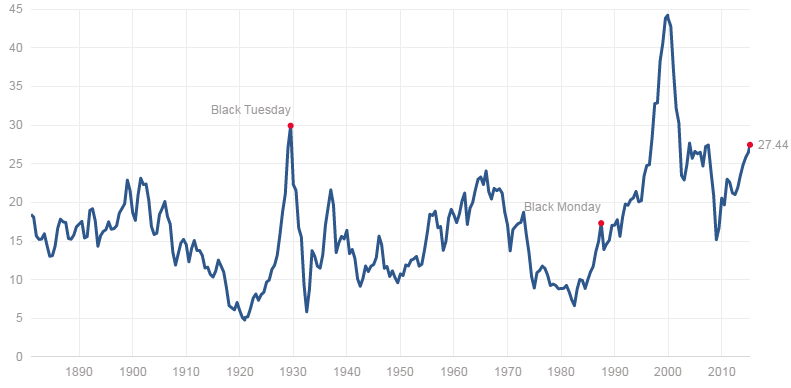

Forget bubble level valuations. Despite the mountain of evidence to the contrary, including the chart above, Mr. Bernanke believes the stock market is not even that expensive. In his recently published blog post Mr. Bernanke writes…

Stock prices have risen rapidly over the past six years or so, but they were also severely depressed during and just after the financial crisis. Arguably, the Fed’s actions have not led to permanent increases in stock prices, but instead have returned them to trend.To illustrate: From the end of the 2001 recession (2001:q4) through the pre-crisis business cycle peak (2007:q4), the S&P 500 stock price index grew by about 1.2 percent a quarter.If the index had grown at that same rate from the fourth quarter of 2007 on, it would have averaged about 2123 in the first quarter of this year; its actual value was 2063, a little below that. There are of course many ways to calculate the “normal” level of stock prices, but most would lead to a similar conclusion.

I can poke so many holes in the statement above that it will end up looking like a pound of Swiss cheese. But I am not going it. Instead, I would like to issue a rather simple challenge to Mr. Bernanke.

If you truly believe the stock market is nowhere near being expensive, why don’t you BUY today. Why don’t you show us all that you truly believe in your own BS, make that information public and allocate a large chunk of your portfolio/wealth in an index fund of your choosing. I will be waiting right here.