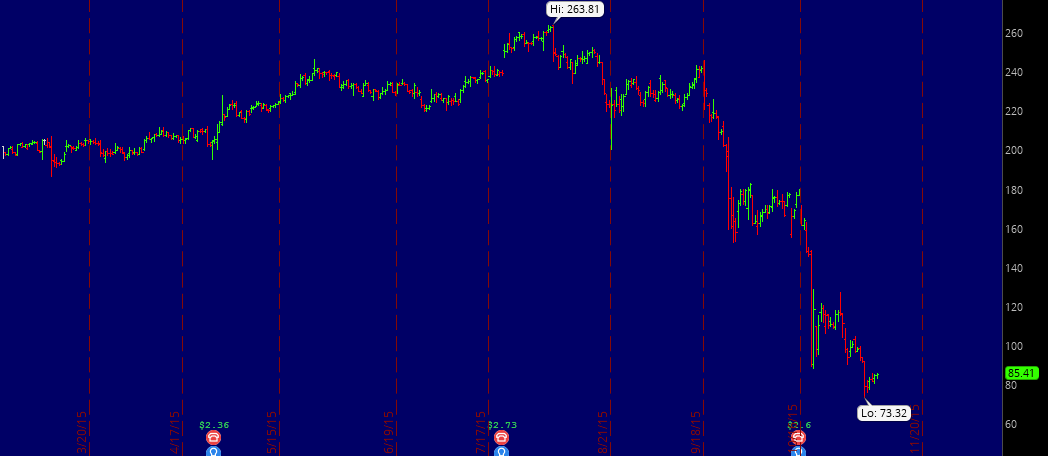

Participate in financial markets long enough and sooner or later you will get your head handed to you. And I don’t care how good you are, sometimes things are simply out of your control. Highly publicized Bill Ackman’s Valeant (VRX) investment is a perfect example of that.

Last week we talked about value investing and how difficult or gut wrenching it can be to purchase great businesses for 0.50….0.25…..0.10 cents on the dollar. What Value Investors Ought To Know About Investing In Today’s Market

Mr. Ackman offers another $2 Billion learning experience (his losses thus far). If you believe in your investment thesis strong enough and your analysis checks out, stay put. Even double up. All successful investors out there had similar defining moments. Ackman says Valeant stock ‘extraordinary bargain’

“Life will go on for Valeant,” he said. “While this has been a very damaging moment for the company … we think the Valeant business is quite robust.” Ackman said he thought the stock was “tremendously undervalued” and had an “89% upside.” He added that investors were forgetting the “rest of Valeant’s business.”

Perhaps another hedge fund manager, Whitney Tilson, has said it the best……

Every investor should analyze this case study to learn from Ackman’s experience, as every last one of us has had (and will have) to deal with a major investment going south. How do you collect more information, filter out the noise, analyze the situation, control your emotions, and ultimately make the right decision among four choices: dump it all, trim, hold, or buy? It is almost never obvious what the right answer is — rather, every option feels really crappy when you’ve lost a lot of money on an investment, especially if you’re in the hot glare of the public spotlight. I’ve been there and it’s no fun.

In other words, if you want to succeed in this business, learn to eat nails for breakfast. Preferably without milk.