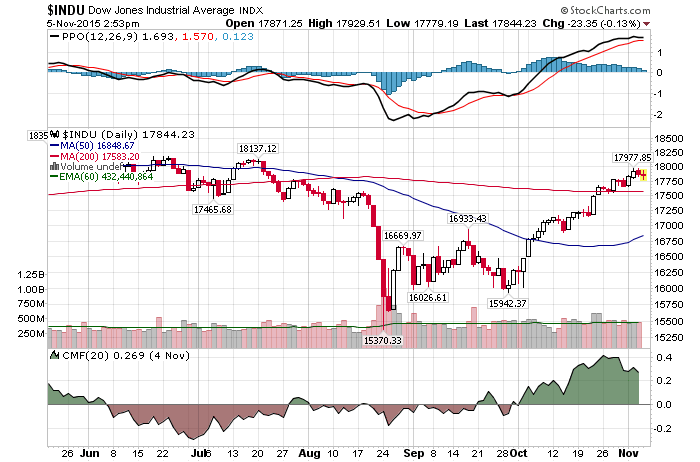

11/05/2015 – A negative day with the Dow Jones down 3 points (-0.02%) and the Nasdaq down 15 points (-0.29%).

Take TIMING away and I am a value investor at heart. Unfortunately, as I have mentioned here so many times before, there is nothing to invest in on the value side. Everything is incredibly overpriced as is evident from the Shiller’s P/E ratio.

Since the market is fairly quiet today, let’s take a look at some interesting quotes from A letter gives a rare glimpse into one of the world’s most secretive — and most successful — hedge funds I highly encourage you to read the whole thing. It is definitely worth a few minutes of your time.

- “Traditional metrics like cash flow and asset values were being blatantly disregarded by the market in favor of newfound metrics such as eyeballs and clicks. High-tech companies were the darlings in a rapidly rising market while less-sexy value stocks significantly lagged.

- It turns out buying a dollar for 50 cents is a lot harder than it seems. Every day we added to these positions, thinking we were getting an even better bargain than the day before, only to wake up and watch prices drop further.

- After countless late nights at the office, I would head home, collapse on my couch and stare at the ceiling. I was unable to read, watch television, or fall asleep. All I could do was worry about what we might have missed in our analysis.

- We see distressed sellers, illiquid securities, huge redemptions, and an excess of paranoia and fear. We quickly find a number of interesting opportunities, deploying our significant cash balances as we trade our precious liquidity for mispriced securities. We may lose money in the short term, as we add to our portfolio while prices are dropping. But when markets turn, we expect multiple years of strong profitability.

- Investing in tide markets takes chutzpah. To do so effectively, you need to fly in the face of public opinion, you have to fight normal human emotions, and you have to be prepared to double down on your bets when your conviction is most in question. As Benjamin Graham once said, ‘The investor’s chief problem and even his worst enemy is likely to be himself.’

- On most days, it offers a menu full of bland, unhealthy, and fully-priced choices. We do enough work on the offerings to make sure we aren’t missing anything and often go home feeling unsatisfied and unproductive.

- Warren Buffett said, ‘Big opportunities come infrequently. When it’s raining gold, reach for a bucket, not a thimble.’ When a great opportunity comes around, it is imperative to size it correctly.

- This is by design. It is much easier to make reasoned decisions without someone screaming at you or second guessing your judgment. It’s not always easy, but we try to maintain the same atmosphere and investment process in all markets.

I had two takeaways from all of the above. First, it is never easy. Even buying dollar bills for 50….25…10 cents can be heart wrenching and downright scary at time. And second, if you can figure out market’s long-term swings (major moves) you would be ahead of 90% of investors out there. Coincidentally, that is exactly what we do at InvestWithAlex.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. Noveber 5th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

What Value Investors Ought To Know About Investing In Today’s Market Google

One Reply to “What Value Investors Ought To Know About Investing In Today’s Market”

Comments are closed.