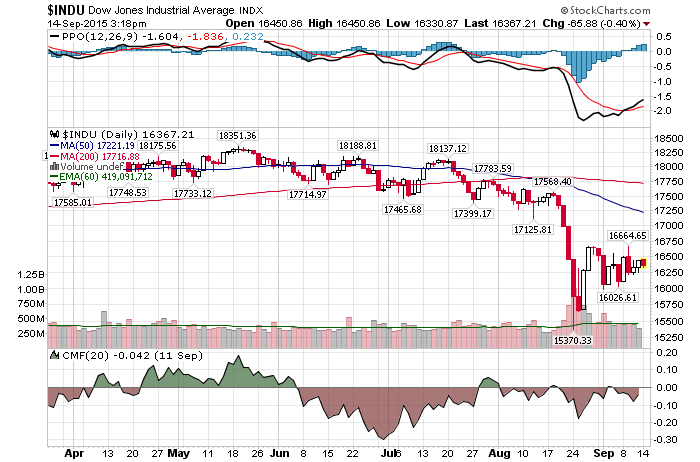

9/14/2015 – A down day with the Dow Jones down 62 points (-0.38%) and the Nasdaq down 16 points (-0.34%).

So, will the FED raise interest rates?

After all, inflation is low, we are approaching full employment (at least according to “their” numbers) and most of the mainstream economists believe that today’s environment is just “peachy”. For instance. ‘No bubbles anywhere,’ so U.S. recovery can run long after rate hike:

In reality, nobody knows what they will or will not do. Even the stock market is clueless right now as it awaits FED direction on Thursday. Or misdirection.

With that in mind, I continue to maintain that almost everyone is missing the big picture here. That is, the FED has backed itself into a corner, it is too late to hike and they don’t really know what to do now. That is why you see Janet Yellen beating around the bush in all of her recent statements. They have no exit strategy as this whole Ponzi Finance bubble is scheduled to come crashing down in the near future.

Well, unless you consider QE-4…5…6 etc…an exit strategy.

Let me put it this way. I am 75% confident that the FED will not raise interest rates at all and 100% confident that they will not raise it in any meaningful way. What is meaningful? Even 8 separate hikes at 25 bps each would be laughable here. And while anything above that will matter, I am extremely confident that we will not even get close to that over the next 2-5 years.

Here is why…….

- Last month China has launched an official currency war by devaluing the Yuan 3 times in a row. Japan is trying to do the same and the EU is threatening further easing and/or QE. In this ocean of devaluation, the US cannot afford to have a strong currency.

- Plus, the US Economy is rolling over into a recession. Some of today’s official numbers are starting to reflect that.

- We are on the verge of a massive down leg in our equity markets. At least based on my mathematical and timing work.

- Commodities have collapsed.

- Deflationary forces are reappearing throughout the economy.

- Etc….

As I have mentioned above, this is the worst case scenario for the FED. They are already TOO LATE. Now they are stuck in a situation where our economy and capital markets collapse while they are rendered powerless. As soon as other investors realize that……well…….watch out below.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. September 14th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!