I always pay attention when somebody, big or small, begin to run around yapping about their stock position. But not in a positive way. I am always interested if there is an opportunity to take the other side of the trade.

Let me give you an example. A few months ago some guy was running around in various public forums and screaming at the top of his longs that Netflix (NFLX) was going to collapse based on his fundamental research. Not only that, he was so confident that he wasn’t shying away from disclosing his massive Put Option position. As accurate as his fundamental analysis might have been, Netflix did the exact opposite, staging a massive rally. Gaps included. I can only imagine that the person in question was whipped out in a matter of minutes.

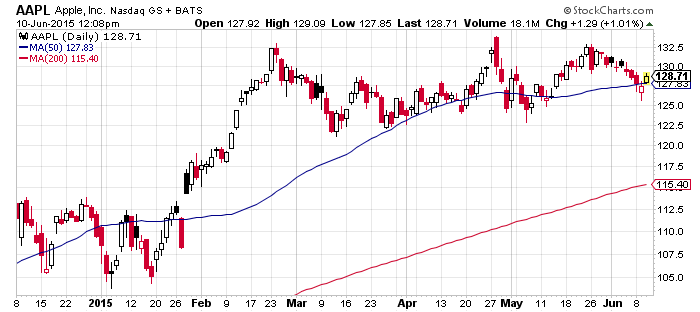

Here we go again, The last time Apple did this, it rallied 55%

Sure, the chart above can be interpreted as “base building” before the next push higher, it can also be interpreted as “distribution”. It is anything but strong. And just because that’s the way it worked out last time, doesn’t mean it will play in the same fashion again. Plus, there is this, Alert: Smart Money Is Trying To Distribute Apple (AAPL) To Fools

In the final analysis, don’t ever disclose your trading position. It rarely pays off.