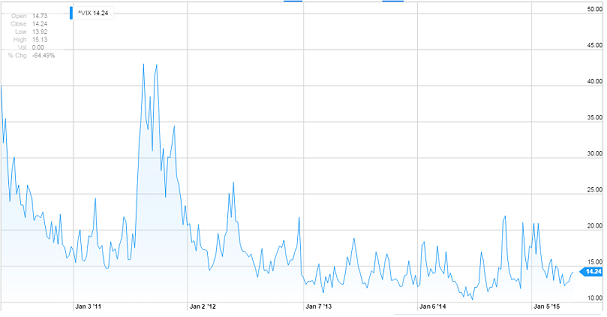

VIX/VXX continue to trade at the bottom of their respective trading ranges. Over the last few weeks our podcast discussed how commercials are building a massive long position in volatility. They might not be the only ones.

Almost $100 Million of VIX Options Traded Hands in a Split Second Today

Is someone hedging or are they simply building a massive long position in volatility? While we won’t know for sure, here is what we do know.

- The stock market has been stuck in a fairly tight trading range over the last 10 months (NYSE). Even more so over the last 5 months. Driving volatility lower.

- Most stocks are selling at dizzying valuation levels.

Both are temporary. In other words, longer-term, someone is making a smart bet by accumulating volatility (VIX/VXX) at or near today’s levels. Once a bear market kicks in and we break out of this trading range, volatility should skyrocket. If you would like to find out exactly when we anticipate that to happen, please Click Here.

Why The Smart Money Is Betting On Surge In Volatility Google