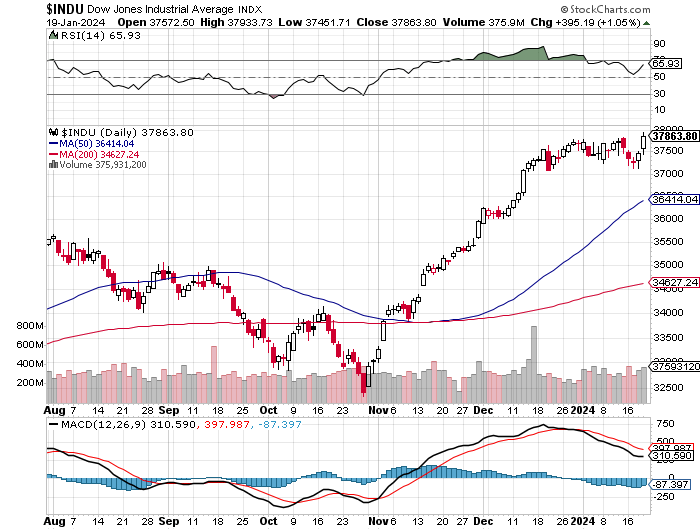

1/19/2024 – A positive day with the Dow Jones up 395 points (+1.05%) and the Nasdaq up 255 points (+1.70%)

The market continues to behave exactly as our time/price calculations project.

A couple of interesting articles today…….

Stocks & Bonds Tumble After Fed’s Waller Sends Rate-Cut Odds Reeling

-

- At first glance, Fed Governor Chris Waller’s comments were more of the same – data-dependent, mini-mission-accomplished, be careful of easing financial conditions, and the market seems over-enthusiastic about 2024 policy. But it was the level of detail he added – and the flip-flop-ish nature of his comments – that colored the market’s perceptions hawkish (full speech here).

Stocks, Bonds, Oil, & Gold All Down As Waller Wrecks Rate-Cut Party

-

- Comments by Governor Waller in a speech and discussion today raised the risk that the first cut could come slightly later than the market’s expectation of March and that the pace of cuts could be quarterly from the outset, rather than the market’s more aggressive forecast of three initial consecutive cuts followed by a switch to a quarterly pace.

We made a shocking prediction last week. Not only the FED won’t cut, they will continue to hike, at least for the time being. Here’s why…..

Because the market will force them to.

Keep raising rates….are you out of your mind? Yes and No!!!

Earlier in the day we updated our mathematical Time/Price 10-Year Note (TNX) Forecast You Won’t Believe What Interest Rates Will Do Next

In that forecast, while we do not share exact Time/Price targeting data, we do suggest that TNX hasn’t topped yet or that October’s high was not the final high. In other words, another leg higher is expected.

Here is the thing. The FED tends to follow the market and not lead it. Particularly the short end of the curve. Over the years I have presented a mountain of evidence to support this notion.

Meaning, if our overall TNX calculations are correct, and I have no reason to doubt them, interest rates are about to surge higher one more time. And if so, the FED will follow.

And that, ladies and gentlemen, should get very interesting.

Having said that, if you would like to find out what the stock market will do next, in both price and time, please Click Here.