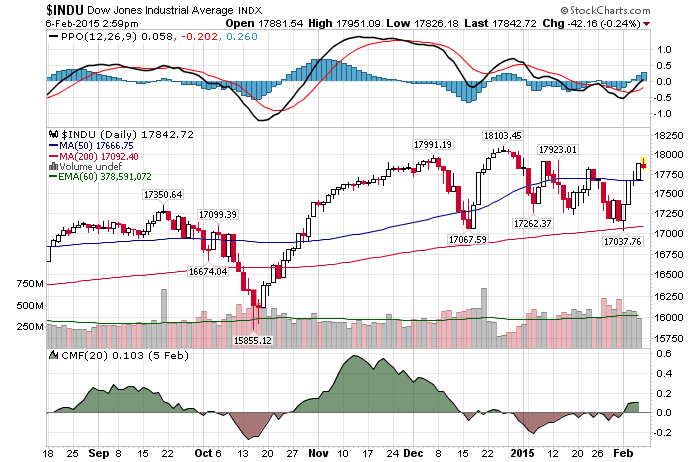

2/6/2015 – A down day with the Dow Jones down 62 points (-0.34%) and the Nasdaq down 20 points (-0.43%).

It was a big week for the overall market. A near collapse turned into a massive rally and the bulls are, once again, out in force. With that in mind, a number of important red flags remain. We have talked about some of them in Thursday’s update. Here are some warning signs that other “smart” investors are seeing.

John Bogle: The Stock Market Is Ignoring Big Risks

John Bogle, founder of the Vanguard group, spots quite a few risks.

- The market is nervous.

- Numerous financial, economic and macro/war risks.

- We can easily see a 25-30% correction.

- Keep buying.

The market is ought to be nervous. It has been close to 6 years since the last real bear market correction ended on March 6th, 2009. And as I so often suggest, bull market runs don’t typically last for more than 5 to 5.5 years. It’s quite strange, but most markets have not moved very much since July 17th, 2014 top (5.5 years). An ominous sign or just another data point to ignore? Click Here to find out.

David Stockman: Didn’t Anyone Notice US Company Profits Are Falling, Not Rising?

The stock market is not cheap. On the contrary, today’s valuation levels are some of highest in history. I have beaten this point to death over the last year. David Stockman tends to agree.

The huge valuation gains in stocks during the current bull market have nothing to do with an honest marketplace, and the cheering on Wall Street is bound to be replaced by tears, according David Stockman, White House budget chief during the Reagan administration.

Stockman estimates fourth-quarter S&P 500 earnings are actually down 5 percent from the year-ago period, but there has been little mention of that fact in media coverage.

“That’s because the talking heads invariably reference ‘adjusted’ or ‘ex-items’ earnings, which, almost by definition, exclude charges for every imaginable business mistake and bonehead executive action — such as soured M&A [merger and acquisition] deals and ‘restructuring’ expense — that could possibly cause earnings to go down.

I couldn’t have said it better myself. And since REAL earnings are going down, corporates are guiding down and buybacks are slowing, at what point does this speculative P/E expansion snaps back? And what would that mean for the stock market….a 30-40-50% haircut? I think we are about to find out.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. February 6th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Why Some Very Smart Investors Are Worried About This Market Google