Even though I am not a permabear, as I participate on the long side just about as much as I do on the short side (when the time is right), bear hate e-mails has been hitting my mailbox in a fairly steady fashion over the last few weeks.

Why? I have no idea, but I am starting to think that the bulls are getting fairly sick and tired of today’s trading range. As you know, most stocks are slightly down from a year ago, as represented by the NYSE, the largest index by capitalization.

For intance, this rant….. Morgan Stanley’s stock-market guru throws shade at the greatest stock-market call of all time

“We all know lots of people who have called 17 of the last zero corrections,” Parker wrote in a note to clients on Monday. Firstly, we aren’t inclined to give them credit when they are finally right.”

“We are nice people, but most of us would have been banished from the money management industry by 2000 if we were bearish the whole way up on [technology, media, and telecom] valuations,” the note said. “Timing matters, and we will continue to monitor the economic, corporate, and credit laundry list to attempt to call the top.”

In the end, Parker said he didn’t see a major market correction coming anytime soon and he was loath to call a top where he didn’t see one forming.

So, let me get this straight. Even if I am right and the stock market drops 30-50% here, I am still an idiot who just got lucky. That’s fine with me, but there quite a few people who would disagree with you at the present time Mr. Parker. Soros, Rogers, Icahn, Faber and the list goes on.

This is important from a psychological perspective because the bulls are getting desperate and angry. They are coming up with unreasonable and dangerous assumptions that the top is nowhere near. Even if it’s already behind us. They are getting ready to hold position until it is TOO LATE to sell. This sort of behavior is typical at market tops. Just be aware of it.

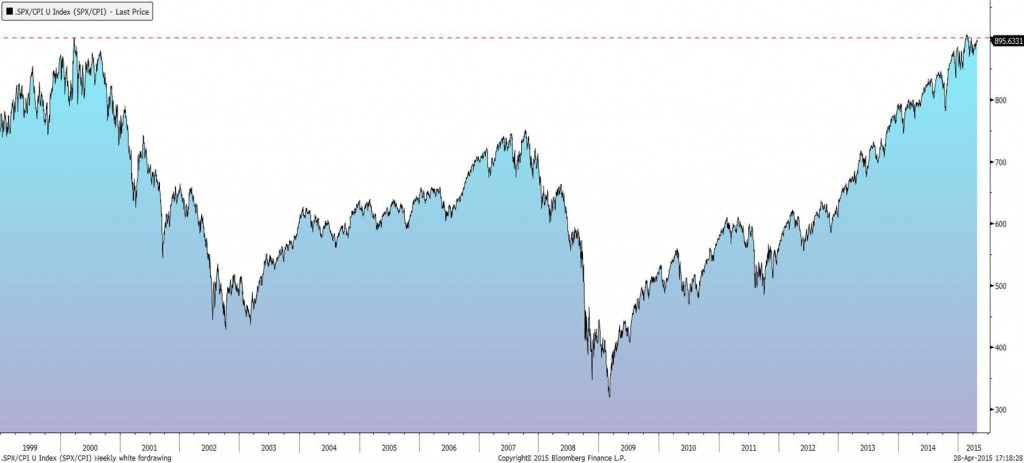

Oh, and one last thing for Mr. Parker. You do realize that the inflation adjusted Dow/S&P are sitting at a break even point from their respective 2000 tops, while the Nasdaq is still down 15%….right? That stands for no real gains over the last 15 years and we are now on a verge of the next bear leg. This kind of blows are giant hole in your “Bears are Idiots” thesis, doesn’t it.