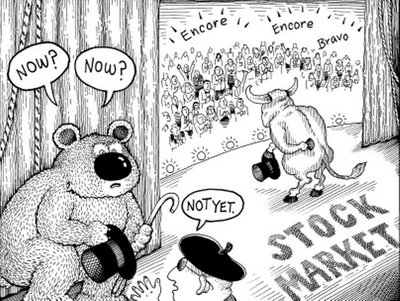

Over the last few days and in the last night’s update we looked at the bullish side of the story. Let’s now switch gears and see what the bears think. Here is just a small sample….

- Risk of a recession may be higher than you think

- Warning: No volume behind 8-week Nasdaq advance

- You Call This A Bull Market?

- Investors Stockpile Cash, In Latest Hint that All’s Not Well for Stocks

Let’s for a second forget about the fundamentals, which point to a bubble, and concentrate strictly on the technical side of the equation. At this juncture a good technician should be able to argue both sides of the market with conviction. In other words, the market finds itself at an important inflection point with multiple indicators pointing in different directions. We either initiate a breakdown from today’s levels or the rally is likely to continue. Not much help here, I know.

I will leave you with this. None of the indices put in an important base at January/February lows. The rally off of this low was entirely too loose, too fast and with no heavy volume supporting it. Plus, a number of large open up gaps remain. Typically, from a technical perspective alone, such rallies (or bounces) tend to fail at the rate of 80-90%.