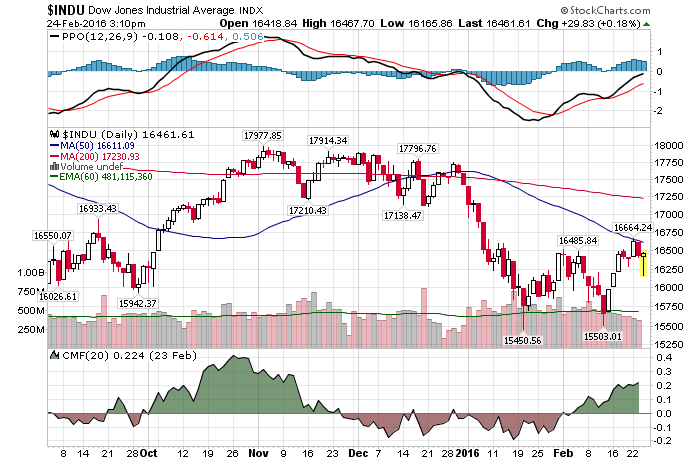

2/24/2016 – A positive day with the Dow Jones up 53 points (+0.32%) and the Nasdaq up 39 points (+0.87%)

2/24/2016 – A positive day with the Dow Jones up 53 points (+0.32%) and the Nasdaq up 39 points (+0.87%)

Over the last few weeks I have suggested that the market will drive both bulls and bears up the wall. Today is a prime example. Just as the bears got excited after a two day 500 point drop on the Dow, the market promptly turned around to crash all Armageddon dreams with a quick 300+ point rally.

This will continue until a certain Time/Price point is reached in the future. If you would like to find out where that point is and where the market will go after we get there, please Click Here.

At least for now, negative headlines continue to dominate the news. Here is just a small sample from today.

- It is worse than anyone thought on Wall Street

- BlackRock Warns Bond Traders They’re Underestimating the Fed

- Hedge funds are getting ready for Armageddon

- Guy Hands: ‘Very, Very Scary Market’ for Investors

- Indicator has a big warning for the market

Let’s look at the last bit….

“We’re probably going to have a pretty volatile 2016,” Rhoads added. The second piece of the puzzle, found in the options market, may signal the direction of that move. Sadly for bulls, it could be to the downside. Rhoads notes that options traders have been buying twice as many upside bets compared to downside protection on the VIX this year. This positioning shows the market is biased toward a higher VIX, which comes when there’s a view that the stock market will drop.

If I was a bear (and I might be) I would be concerned with so much negativity out there.

On the flip side and fundamentally speaking, the market has detached from any sort of reasonable reality quite a long time ago. Suggesting that a rather violent correction might lie ahead. Just as VIX/VXX volatility patterns suggest. I wrote about it before What You Ought To Know About Today’s Fundamental Picture

Which scenario is the correct one?

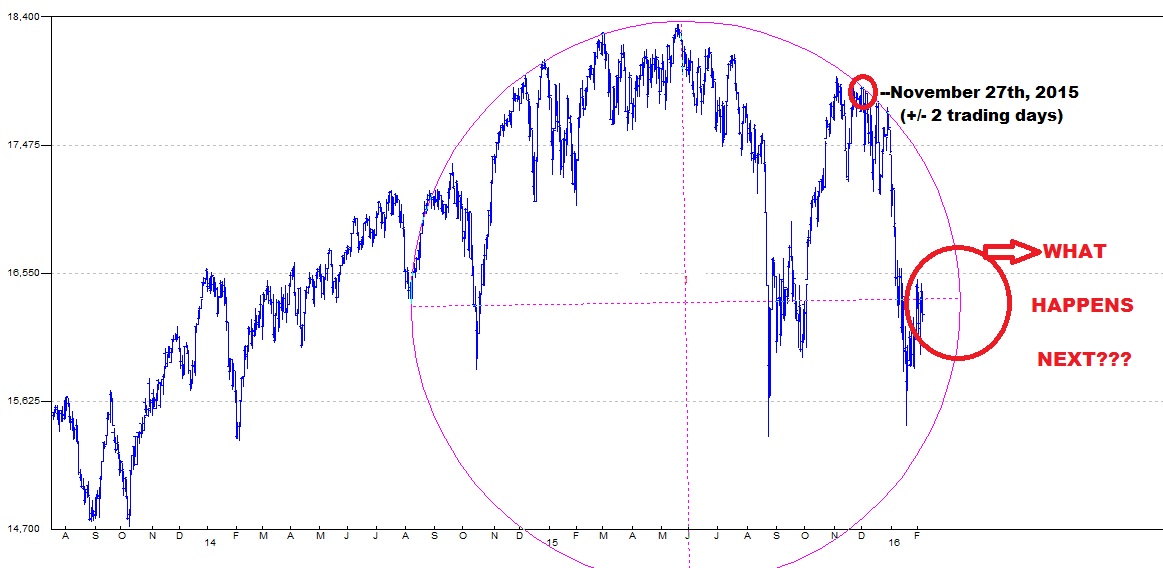

Only TIMING and cyclical analysis can answer that question. And that is exactly what I talk about in this week’s premium update. Clearly outlining what will happen as soon as the chart below complete. Click Here to learn more.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. February 24th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!