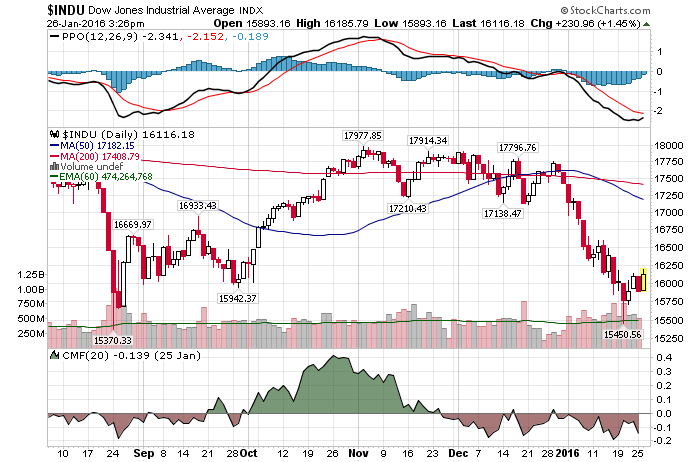

1/26/2016 – A positive day with Dow Jones up 283 points (+1.78%) and the Nasdaq up 49 points (+1.09%).

When the FED raised interest rates by a laughable 25 bps this past December most indices were pushing close to their all time highs. Today, most markets are down 10%+.

And that forces people to come to all sorts of crazy conclusions. Anything from an immediate rate cut this week to negative rates to QE-4. More about that in a second.

As for me, I don’t believe the FED has the ability to change their approach or statement at the present moment. To do so would look bad and confirm that the FED is entirely market driven. In all likelihood, they will raise interest rates by another 25 bps tomorrow and keep their statement intact.

At the same time, the FED is likely to use their powers to stabilize financial markets. As has been previously outlined in my analysis on the subject matter. Here is what I have said at that time.

View maintained since August of 2015.

Excuse my language, but the FED continues to BS the market. And as far as I can tell, the FED is attempting to maintain the market within a certain range. At the same time, it is now crystal clear what their actual game plan is. It goes something like this…..

- Can’t raise or won’t raise. Today’s economy or financial markets won’t be able to digest any rate increases at this juncture. Period. As talked about on this blog so many times before. Why The FED Will Not Raise Interest Rates in any meaningful way. If the FED members have even an ounce of intelligence, and I believe they do, they realize the same.

- If the market declines, issue a “Dovish” statement. Bring it up.

- If the market recovers, issue a “Hawkish” statement. As they did today. Remember, they don’t want things too overheated.

- Rinse and repeat while praying the market and/or the US Economy won’t implode on their own.

That about covers it. There is only one fatal flaw with the plan above. It only works until it doesn’t. It only works until the FED has any credibility left. The problem is, more and more people are beginning to realize all of the above.

As a result of this FED induced disastrous bubble, we will see a number of important structural themes play out over the next few years as the FED blinks and attempts to flood the market with liquidity again.

- The stock market will have a sizable sell-off into 2017 bottom. At least according to my mathematical and timing work. Click Here to learn more.

- Interest rates…-10 Year Note should see a double bottom at around 1.4-1.5% over the next 2 years. 10-Year Note: All Systems Are A Go For A Double Bottom

- The US Dollar should decline. Don’t forget, commercials have a substantial short position against the dollar.

Now, mind you, all of the above is counter to what most investors today expect or believe. That should not come as a surprise. For instance…..

Lamoureux believes the boat is about to tip over and that U.S. equities are at a turning point. He says, “We don’t know where the bottom is going to be…But if you start to step in the market, and you do this gradually over the next couple of weeks, we think we’re at one of the major entry points that will carry the [Dow Jones] for the next 3 to 4 years past 25,000.”

Exactly that line of thinking was discussed in our earlier update today. Listen, if it was as easy as flooding the system with free money, we would all be driving Ferrari’s by now. It is not….not even close. Additional liquidity will have very little impact here and to suggest the market will rally to such an extent is dangerous. If anything, their fundamental view could lead to an all out crash, not a rally. Just as was outlined here Impossible To Inject More Credit – The Jig Is Up

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update.January 26th 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!