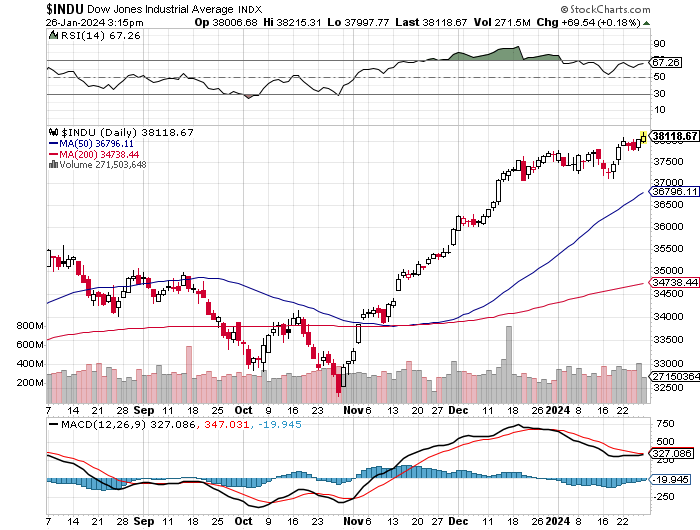

The stock market continues to behave exactly as anticipated.

If you would recall, we saw complete Gloom & Doom at the end of October, with nearly everyone expecting some sort of a market crash. Well, we didn’t, as we continued to maintain that all indices will see new all time highs before it is all said and done.

Today, most investors, professional or not, are dumbfounded by what they are witnessing.

Recession red flags: Wall Street and Main Street are at odds about the economy

-

- The U.S. stock market may be at an all-time high, but the “Wall Street – Main Street disconnect” remains wider than ever — and that spells trouble ahead.

- Specifically, there’s a dramatic difference in perspectives about the health of the U.S. economy. On the one hand is Wall Street celebrating the stock market’s new records, with many believing the Federal Reserve has avoided a recession by executing a “soft landing.”

- Yet the average American is much more pessimistic. I receive numerous emails from readers describing significant and sudden slowdowns in their particular industries and widespread fears in their communities of how much worse it could become in coming months. And the data confirm what they’re saying.

The above is understandable, but our approach to the overall market analysis is rather simple.

You see, the overall market hasn’t yet completed its mathematical pattern that it needs to complete before any further downside is possible. Hence the confusion between today’s fundamental deterioration and the stock market’s apparent positive outlook.

In other words, the market must complete its pattern and hit its mathematical and timing points of force first. And until that happens it will NOT go down. No matter what happens with the overall economy, geopolitically, etc…… It is as simple as that.

If you would like to find out exactly where this time/price point in, in both price and time, please Click Here.