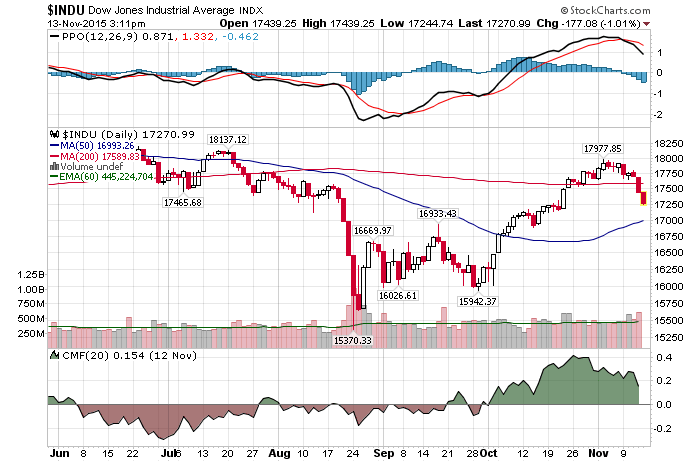

11/13/2015 – Another down day with the Dow Jones down 203 points (-1.16%) and the Nasdaq down 77 points (-1.54%)

At the end of last week most bulls were celebrating. The market was pushing close to previous highs and the Dow 20K was just a few weeks away. That is, if you listen to CNBC. Around that time I published the following article Why I Am More Bearish Today Than Ever. Today, most primary indices, except the Nasdaq, are negative YTD.

But don’t worry…….right? According to most investors, this is just a healthy correction. Maybe. At the same time, very few people have considered the fact that this might be the next leg down. As outlined here yesterday. Just A “Healthy” Correction Or Something More?

Quite a few things to get through as we head into the weekend.

“There is remaining concern about global growth, and it does seem to be slow and, if anything, heading slower,” Keon told CNBC’s “Squawk Box.” “Right now it seems to me the market is still very nervous about growth and also very nervous that the Fed may move and that may have a negative impact.”

I have said it many times before and I will say it again. August 24th low was untradable. Meaning, the stock market is likely to revisit those levels sooner rather than later.

U.S. retail sales rose less than expected in October amid a surprise decline in automobile purchases, suggesting a slowdown in consumer spending that could temper expectations of a strong pickup in fourth-quarter economic growth.

This should not come as a surprise to readers of this blog. At the same time, I am having a very difficult time reconciling where the FED and other investors see this “proposed growth” coming from. Not a good sign when the Shiller’s S&P P/E is at 26.

The maximum size of such “margin lending” will be cut by half to the equivalent of the amount of cash an investor puts up to buy stocks, down from the previous level of double that amount, the China Securities Regulatory Commission announced.

How is that supposed to be good for the stock market?

- Despite tail winds, eurozone economy loses momentum

- Is Europe’s Economy So Bad the ECB Will Run Out of Things to Buy?

Official figures on Friday showed the 19-country eurozone only expanded 0.3 percent in the July-September period from the previous quarter. That was below market expectations for a second straight 0.4 percent rise and piles further pressure on the European Central Bank to offer more stimulus.

Europe is a basket case and it’s getting worse. No surprise there. Mr. Draghi has gone all in with his overbearing stimulus and negative interest rate insanity. The next step, if they ever get there, is an outright monetization.

Considering all of the above, let me ask you something. How can the stock market rally here when the worldwide growth is collapsing, centrals banks have already went all in and the stock market is sitting at bubble level valuations?

Sure, stranger things have happened, but HOPE cannot be an investment strategy. If you would like to find out what happens next, please Click Here.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. Noveber 13th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!