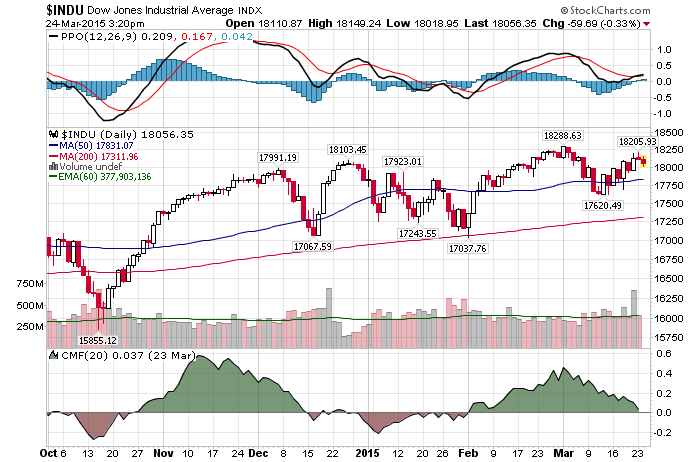

3/24/2015 – A down day with the Dow Jones down 104 points (-0.57%) and the Nasdaq down 16 points (-0.32%)

So, is it time to cash out of this stock market? Let’s take a closer look.

Money pours into stocks-does that signal a top?

Investors have added $46.8 billion to equity mutual funds and exchange-traded funds in March, the most for any month since October 2013.The basic idea is that once everyone buys, there’s less money left to go into the market. Additionally, heavy buying could be seen as a sign of investor exuberance, indicating that stocks are in “overbought” territory.

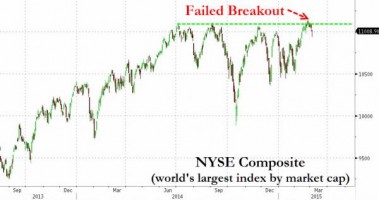

Here is the most important factor that most investors are dismissing. At their own peril. Despite heavy inflows most stocks haven’t gone anywhere since July 17th, 2014. This can be seen on the chart below. This is a bearish divergence as it suggests a prolonged period of distribution, not consolidation.

Fed’s Bullard warns of ‘violent’ reaction if markets misjudge rate path

“I think reconciliation between what markets think and what the committee thinks will have to happen at some point,” Bullard told reporters at London’s City Week financial conference. That’s a potentially violent (encounter) … and I am concerned about that. I am hopeful that markets and the policy committee can come to some kind of meaningful meeting of the minds in the coming months and quarters.”

We can argue about what the FED will do until the sun explodes, but it won’t do any of us any good. If we wish to read between the lines, the FED believes the market might have misinterpreted their “more dovish” statement last Wednesday. Hence, Bullard is going out of his way to suggest rate hikes are still on. The futures market tends to agree.

In a sense, the stock market is now playing chicken with the FED. Who will win? Based on my work, extreme bullish optimism appears to be misplaced at this juncture. If so, right now might be, indeed, a good time to cash out.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. March 24th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!