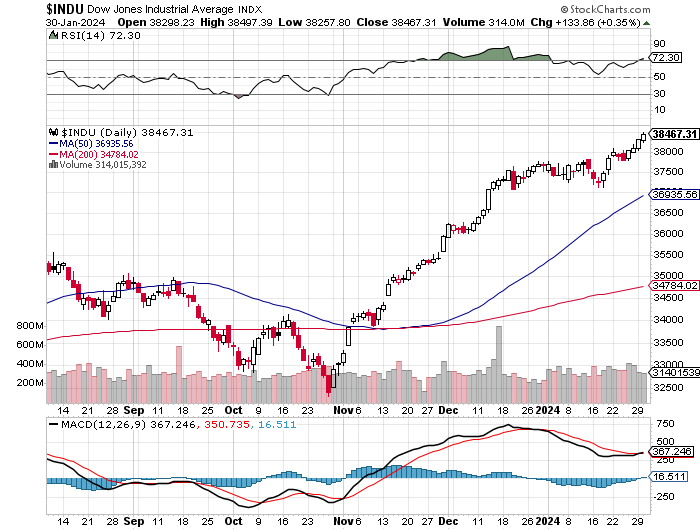

1/30/2024 – A mixed day with the Dow Jones up 133 points (+0.35%) and the Nasdaq down 118 points (-0.76%)

The stock market continues to behave exactly as anticipated/projected.

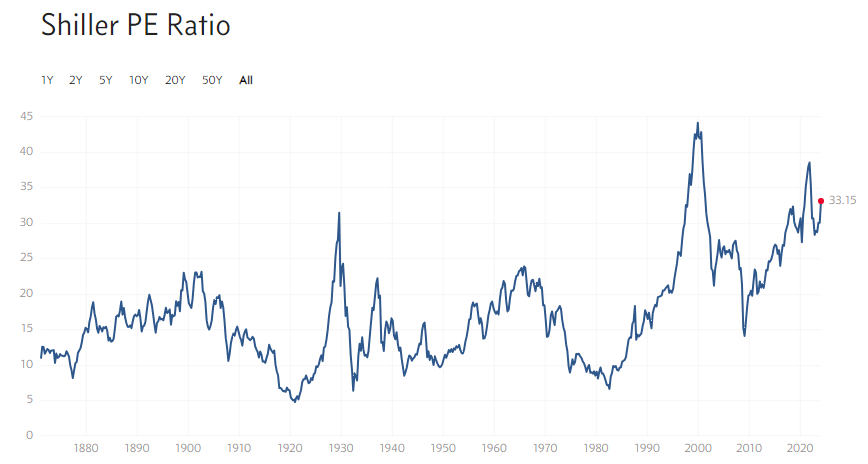

It has been a long time since we have looked at Shiller’s PE Ratio……

Why do I bring this up?

JPMorgan Warns Today’s Market Is “Far More Similar Than One May Think” To The Dotcom Bubble Peak

And I wouldn’t necessarily disagree.

As you can see we have been sitting at extraordinary valuation levels for nearly 10 years now. Today’s valuation levels are on par with 1929 and slightly below 2000 highs. But 2000’s P/E record is somewhat misleading as the index was heavily weighted in tech stocks that didn’t have any earnings.

Long story short, yes, absolutely, the stock market is once again selling at record valuation levels.

Having said that, it has yet to reach its top. As we have been suggesting for some time, the stock market will not complete this bull move until it hits its mathematical Time/Price point of force. If you would like to find out exactly where this point is, in both price and time, please Click Here.