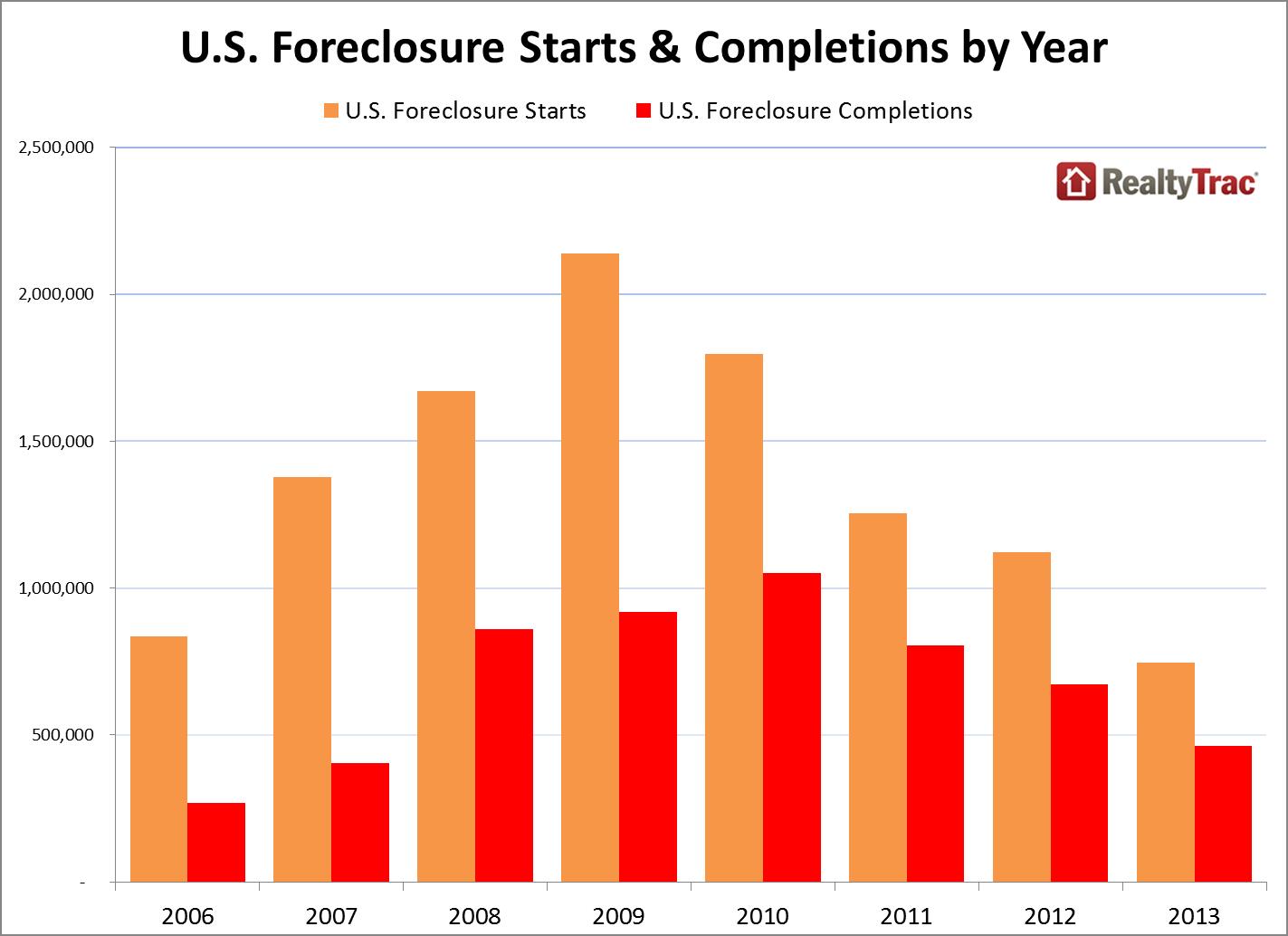

Believe it or not, but since 2006 top, the US Real Estate market plowed through 7 Million Foreclosures. So much for that real estate recovery…aka…dead cat bounce.

Based on my calculations, that number represents 10-15% of American households who have a very bad taste in their mouth when it comes to real estate and “owning their own home”. The American real estate psyche is definitely changing. That is one of the reasons behind why you are seeing the home ownership rate dropping like a rock. Given today’s rebound in prices, unaffordability levels and investor speculation frenzy, there is only one direction this real estate market can go. To see when our Real Estate Market will collapse again, please Click Here to check out our real estate report.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Click here to subscribe to my mailing list

The Impact Of 7 Million Foreclosures Google

There is little bragging that goes on when a poor financial decision is made. You rarely hear about the person that invested a sizeable portion of their retirement account into AOL at the peak or going all in on Enron. The same applies to housing. We are seeing chatter reflect that of 2005, 2006, and 2007. Justifications are different but some people seem to feel they bought at the “perfect” time. Just for the sake of curiosity I ran the numbers of total foreclosures since the crisis began with the housing peak in 2006. In total, 7 million Americans have been served with the bitter taste of foreclosure. On the flipside, since we know that roughly 30 percent of all purchases have gone to investors and Wall Street, we can say that probably over this same period 2,000,000 homes are now in the hands of some sort of investors (i.e., big money, small money, foreign money, and second homes). You also have to wonder how many of these people that lost their homes in foreclosure are itching to get back on the horse and buy again. Credit standards are fairly tough for getting a loan today even though rates are low. And those with the credit and income are battling it out in flippervilles where “all cash” is dominating the scene. There are likely some permanent structural changes that are a result of a stunning 7 million foreclosures.

The 7 million club

From reading the mainstream press all you hear are glorious signs of housing resurrection! Come one come all into the house of real estate where the almighty Fed will allow no harm to occur. Just sign and pray and the next thing you know you’ll be the next Donald Trump. The flipping, rehabbing, and housing shows are once again filling the space on a cable station near you. The perception of the Fed being this almighty protector of housing makes a bit of sense but where was the Fed in 2007? Last time I checked the Fed came into existence in 1913, over 100 years ago. Frankly, the Fed on their list of priorities has: to keep member banks afloat, keep financials steady, a deep attempt to protect the bond market, and more importantly keep interest rates low on our massive $17+ trillion national debt that will never be paid back. Housing is low on the list of priorities especially with many of the foreclosures now shifting to “stronger” hands.

You wouldn’t know it but since the peak in 2006 we have witnessed 7 million foreclosures:

Even in 2013 we had 1.4 million properties with notice of defaults, scheduled auctions, and full on REOs taken on. Early in the crisis these stories were common since they were a novelty to the press. Now however, many of these properties are shifting over to large investors pushing inventory up. A clear consequence of this is a large pool of potential buyers that are unable to buy. 7 million households now have a marred credit history. In many hot metro areas given the 2013 jump in prices to get the best rates you will need good credit. Contrary to nonsense being spouted you actually need a solid income to compete in any high priced metro area. Plus, we are assuming this foreclosed club is even interested in buying again. Many are opting to go the renting route.

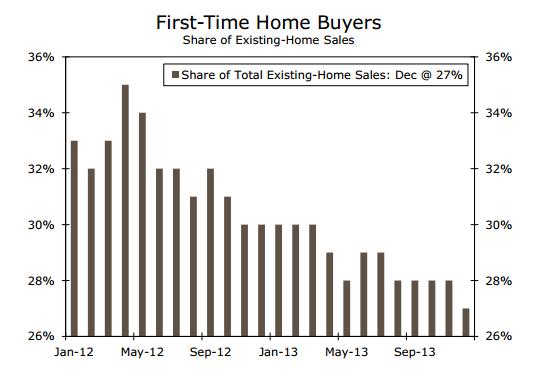

The assumption is that the market is being driven up organically by regular households and that is not the case:

Source: Wells Fargo

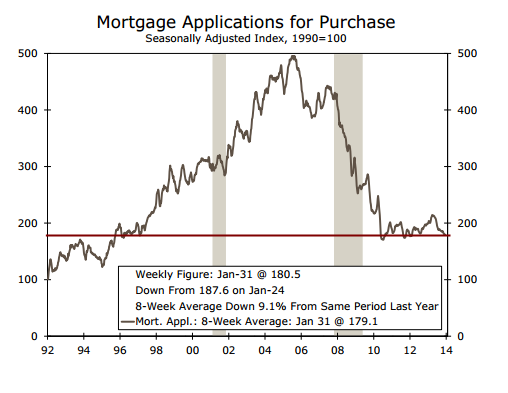

The number of first time buyers is pathetic because household formation is weak and many young Americans are living at home with mom and dad. Forget about buying, they are having a tough timepaying higher rents to the new feudal landlords. You would expect with the rapid rise in prices that existing home sales are off the charts but they are not. For most people in the perpetual serf demographic, a mortgage is necessary to buy but look at requests for mortgages via applications:

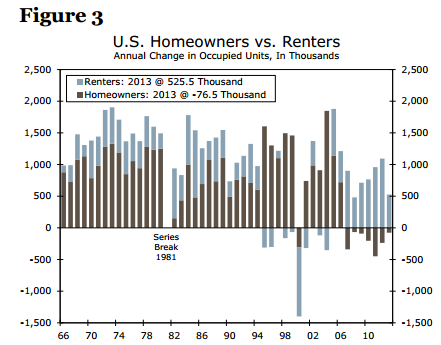

We are back to levels last seen nearly 20 years ago! Only difference is that we have 50,000,000 more people today walking the streets of the U.S. of A. than we did back then. Since access to middle class living is getting tougher thanks to weak income growth, more people are opting to rent:

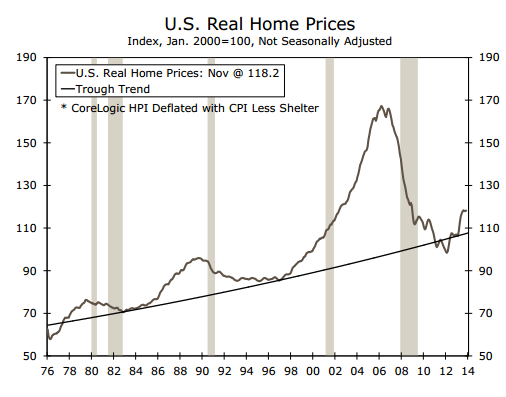

We continue to add a large number of renting households. For the 7 million foreclosed souls, credit destruction might force their hand but many might have gotten a healthy vaccine from the “real estate only goes up” mantra. We have new folks taking their chance at housing roulette with placing a massive bet on red and many diving in with ARMs to stretch their budgets to the fullest potential. Some luck out but only if their timing aligns with bigger macro events. They then back fill the narrative to justify their behavior. Confirmation bias! It might come as a shock that many things that happen to you, good or bad may have nothing personal to do with your decisions. I’m sure we have some aspiring Trumps in Greece or Liberia but the environment isn’t setup for mad real estate speculation. You also had many that escaped the last crash by tiniest of margins. Say someone that made that last fabulous flip in Compton, Pacoima, Palmdale, Las Vegas, or any market that is eons away from the peak. Where they masterful timers? Unlikely. They lucked out. The massive bubble forgave their sins. But it doesn’t forgive all. The beauty of this QE juiced market is the Fed has turned us all into speculators whether we admit it or not. By default you are playing this game whether you want to or not. Cautious and have your money in a safe bank or CD? Inflation is eroding your purchasing power. Thinking of buying? This might be a turning point:

Gains are stalling out largely because investors are slowly stepping back and households are still trying to gain their footing in this new economy. Those 7 million foreclosures are massive and those people walk amongst us. It is unlikely that we will hear their horror stories in mass. Even in the crash days of 2007 through 2012 (the trough) you were hard pressed to see people discuss this openly. Yet the confirmation bias going on right now is frothy and does remind us of 2006 and 2007.

Want to see some of this insanity in action? A commenter pointed this gem out:

2125 VALLEJO St

Los Angeles, CA 90031

4 beds, 3 baths (listed at 3,500 square feet)

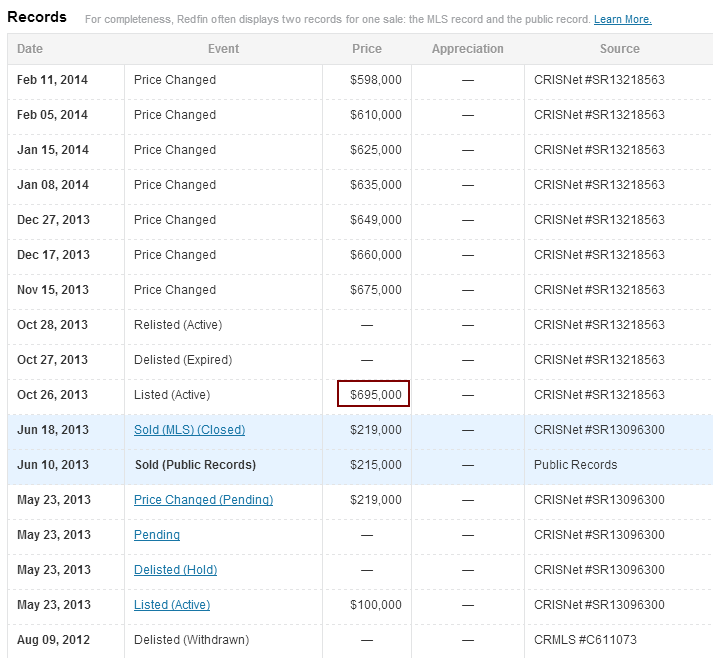

The house is currently listed at $598,000. But let us look at the sales and listing history here:

They actually tried selling this place for $695,000! The last sale price was $219,000 in 2013 which tells us some major rehab work went on here. But $476,000 worth of work? Come on now. Even the sellers don’t believe this and that is why they have dropped the price nearly $100,000. Thankfully Google gives us a bit of a glimmer of the home pre-makeup and Photoshop filters:

People are pulling figures out of thin air here especially with that $695,000. The schools in this area are sub-par so factor in tens of thousands of dollars to send the kid(s) to private school. This home qualifies for a Real Home of Genius Award. In the game of musical chairs, there can only be one winner. It is about timing. There are many signs showing a tipping point is occurring. Unlike stocks, real estate turns around like a large cargo ship, slowly and surely.

While we may not hear much on those 7 million foreclosures, rest assured that many Americans are no longer in the camp that believes the Fed can do everything and anything to keep prices up. For the big players, real estate is merely one tiny piece of their portfolio like owning a Rembrandt or fine jewelry. Most of their wealth is in stocks and bonds. Ironically Wall Street owning rental property is going to put them face to face with the proletariat and will soon come to realize that you can only raise rents based on local area incomes. Try cash-flowing a property in Santa Monica or Pasadena at these rates. Even flippers are starting to enter pricing purgatory one bad flip at a time. At least someone will get a new granite countertop sarcophagus home built in the 1800s with hardwoods floors!