4/27/2016 – A mixed day with the Dow Jones up 53 points (+0.29%) and the Nasdaq down 25 points (-0.51%)

Well, it appears the FED theory I first outlined on this blog over six months ago, a theory summarized in this morning’s blog post, is dead on. We did see a more hawkish statement, meaning, the FED is indeed trying to maintain the market within a certain range. Something they will ultimately fail at.

But enough about me. Let’s see what some other folks out there think…..

“That didn’t work very well. The stock market crashed and the credit markets were a disaster,” Gundlach says. “The markets have humiliated the Fed into abandoning their pretty idiotic forecast.”

Yes, I couldn’t agree more.

Central banks across the globe are currently battling to stimulate inflation and growth by using near- and even sub-zero interest rates, and huge programmes of quantitative easing. So far nothing seems to be the silver bullet for growth, with negative interest rates in particular seen as something of a failure. Edwards argues that as well as failing to help normal people, monetary policy is making the rich richer, stirring anger and resentment among normal people.

Dead on.

Thus, we see widespread signs of a decline in long-term inflation expectations. We know the potential consequences from the experience of Japan, which has suffered more than one “lost decade” of extremely low inflation and disappointing growth. If it’s not remedied, interest rates and inflation will remain low, and the Fed’s ability to buffer the economy against adverse shocks to prices and employment will remain greatly restricted.

This is fairly easy. Massive amounts of debt always lead to deflation. Only outright monetization can spark inflation now.

I wouldn’t be so eager to buy bonds here. Even if the FED downright forgoes further interest rate increases, goes negative and/or introduces another round of QE, there is no guarantee that bonds will react in a way most people think. I can make a powerful argument that they will do just the opposite.

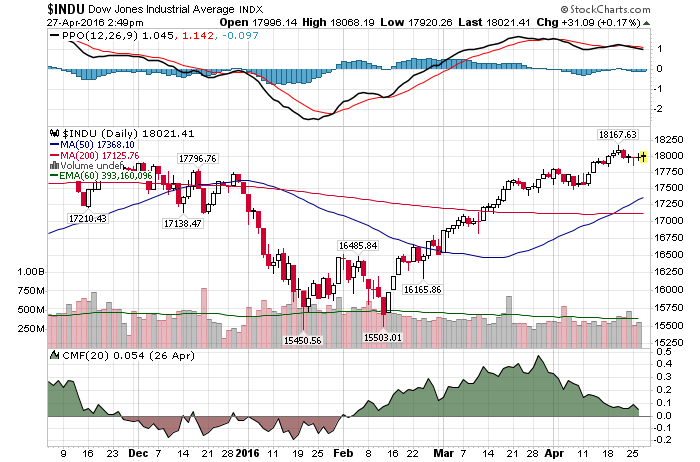

Here is the bottom line. No matter how you twist this equation, we are in a massive speculative bubble. With stocks selling at 3rd highest valuation level in history. Right behind 1929 and 2000 tops and on par with 2007 top. All while the FED literally out of tools to fight the next recession. ![]()

I can tell you this. The above setup is does not bode well for the overall market.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 27th, 2016 InvestWithAlex.comv

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!