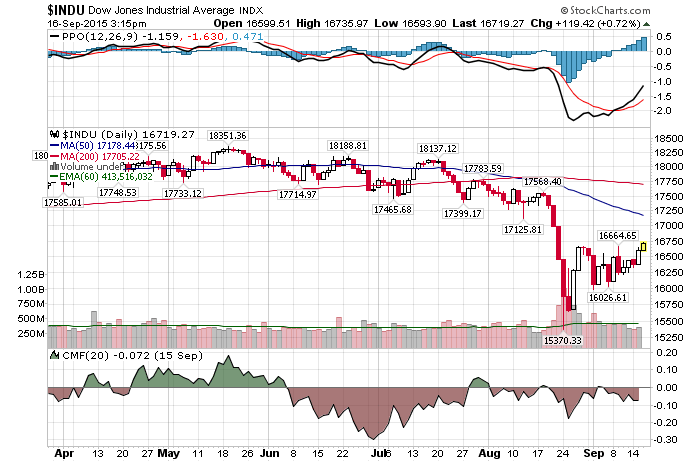

9/16/2015 – Another positive day with the Dow Jones up 138 points (+0.83%) and the Nasdaq up 29 points (+0.59%)

I have never deviated from my 2006 call that we are in for 10-20 years of deflation. Well, unless the FED begins to print money outright and triggers hyperinflation and/or various degrees of currency devaluation.

And even though deflation has vanished over the last few years, there is a difference between covering it over with money printing (QE, zero interest rates, etc…) and it going away structurally. Guess which is the case.

Now that the flood of liquidity is vanishing, deflation is once again beginning to rear its ugly head.

Weak U.S. inflation complicates Fed rate decision

Bill Gross tends to agree.

Gross Sees Global Economy Dangerously Close to Deflation

Once there is a “whiff of deflation, things tend to reverse and go badly,” Gross said Friday in a Bloomberg Radio interview with Tom Keene. Gross pointed to how the CRB Commodity Index isn’t just at a cyclical low, but lower than in 2008 when Lehman Brothers Holdings Inc. went bankrupt.

Deflation is not bad. Well, unless your economy is leveraged to the hilt and you have to rely on low interest rates and money printing to wiggle your way out of it. As is the case with most, if not all, global economies.

Can anything be done to prevent deflation at this juncture?

Sure, an outright debt and currency monetization. Something the FED has been trying to do for quite some time. Something that they have failed to do despite introducing a $1 Trillion QE and keeping interest rates at zero for way to long. That is not to say that they won’t be successful in the future, but rather, to suggest that blatant currency destruction is the only viable option they have left.

In other words, there is no possible outcome where this ends well. And while they might be successful at keeping deflation at bay for a little bit longer, eventually it will overwhelm the global economy. Just take a look at Japan and you will have a fairly good idea about how this ends.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. September 16th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!