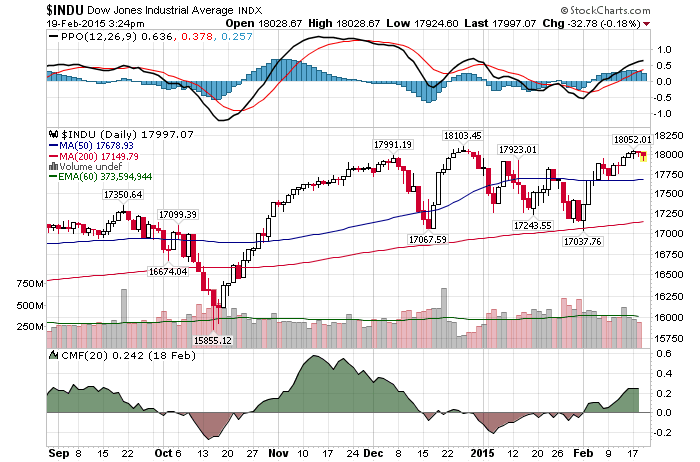

2/19/2015 – Another mixed day with the Dow Jones down 44 points (-0.28%) and the Nasdaq up 18 points (+0.37%)

The stock market remains in a tight trading range. Just as anticipated. If you would like to find out when that ends and what happens next, please Click Here.

Today’s mainstream financial media is about as useful as a pound of snow at the North Pole. For instance, I had a good chuckle when I saw the following headline. Japan Stocks Rise Toward 15-Year High And while the article perpetuates “all is good in the land of financial bubbles” mindset, the reality is anything but that.

As the chart below suggests, the Nikkea is still down over 50% since its top 25 years ago. Plus, it is approaching an important resistance level. We have covered this topic in greater detail in one of our weekly Podcasts and what that means. In short, given today’s macroeconomic picture, currency wars, Japan’s outright attempts to monetize their economy and a certain technical setup, the likelihood of the Nikkea going much higher here is slim.

Point being, try to ignore financial media when it comes to making your investment decisions. As is evident today, they become increasingly bullish at or near major tops (as today) and incredibly bearish at various bottoms (ex. 2009). Tune them out, do your own research and realize that we are, once again, in a midst of a giant financial bubble.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. February 19th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!