3/2/2016 – A positive day with the Dow Jones up 34 points (+0.20%) and the Nasdaq up 14 points (+0.29%)

When I was shorting stocks in May of 2015, I distinctly remember Marc Faber throwing in the towel and suggesting that stocks might never go down again. Due to FED’s intervention. He is at it again……

Dr. Not So Doom: Marc Faber says stocks may rally

“That could drive the market up to maybe around 2,050, but I don’t necessarily see new highs, and if new highs happen, they will happen with very few stocks participating,” he said.

Fair enough. Yet, confusion among market participants continues to dominate. And while some attempt to explain away the rally Reasons Behind the Rally in Equity Markets others openly admit confusion, frustration and complexity associated with today’s market environment. TOP HEDGE FUND MANAGER: ‘The future for me is now more uncertain than at any time I can remember’

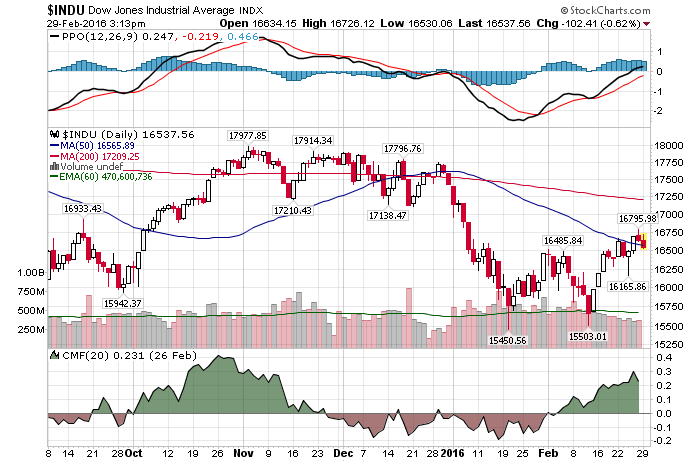

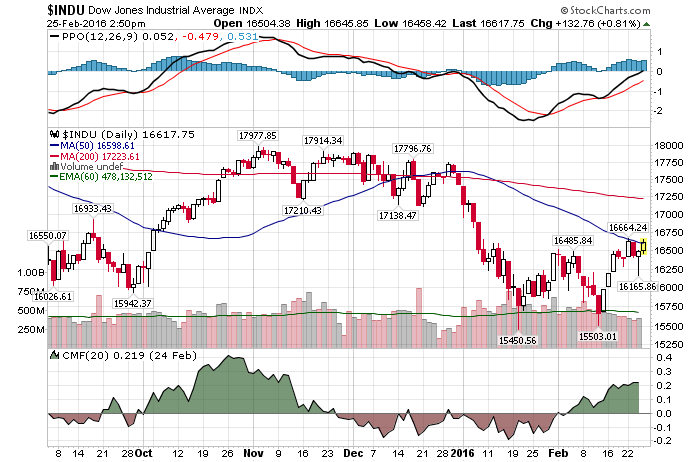

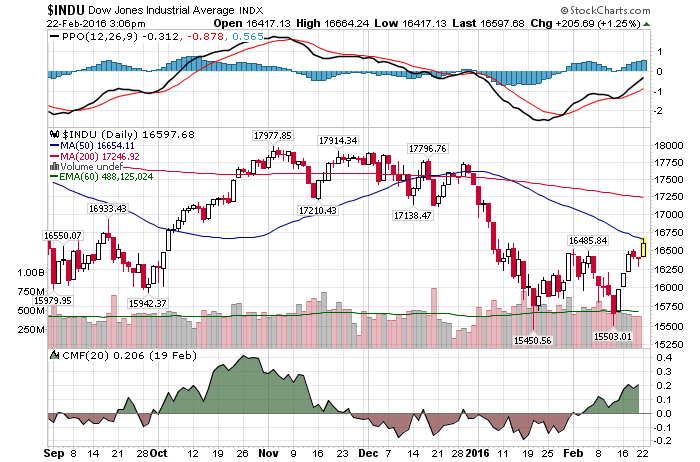

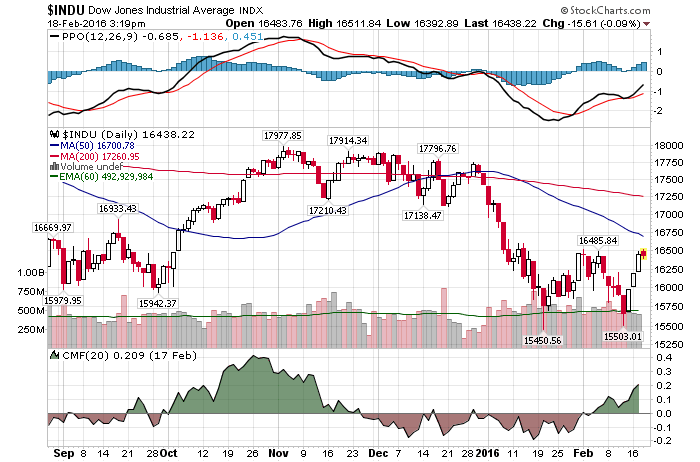

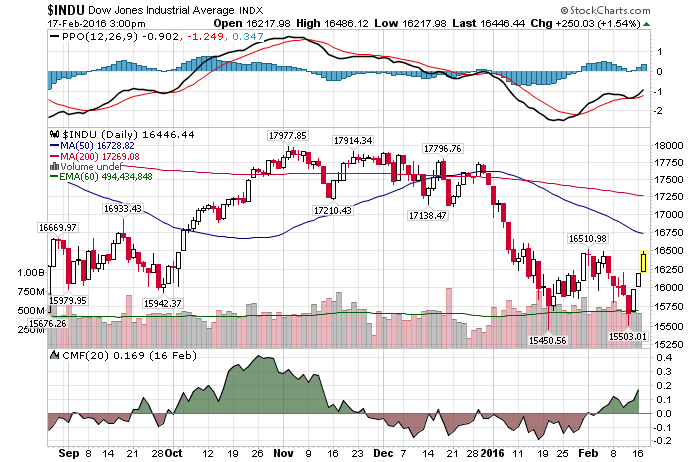

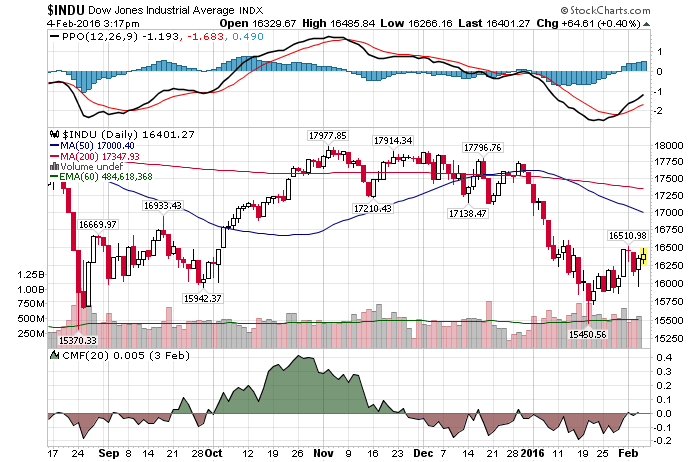

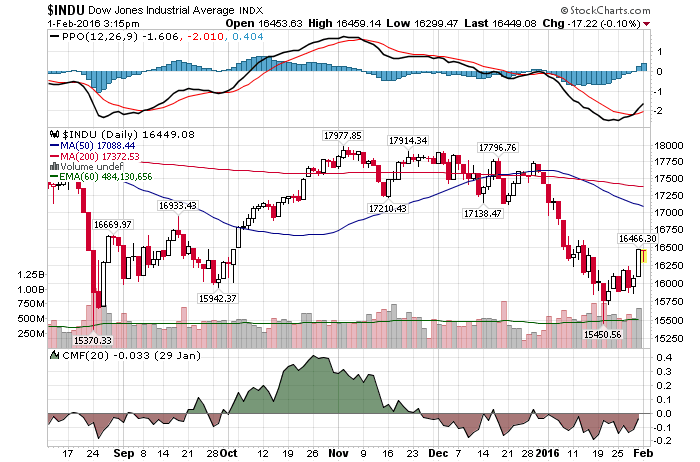

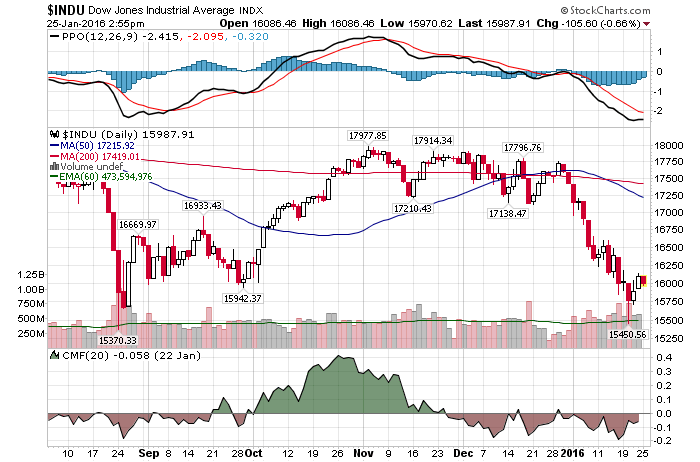

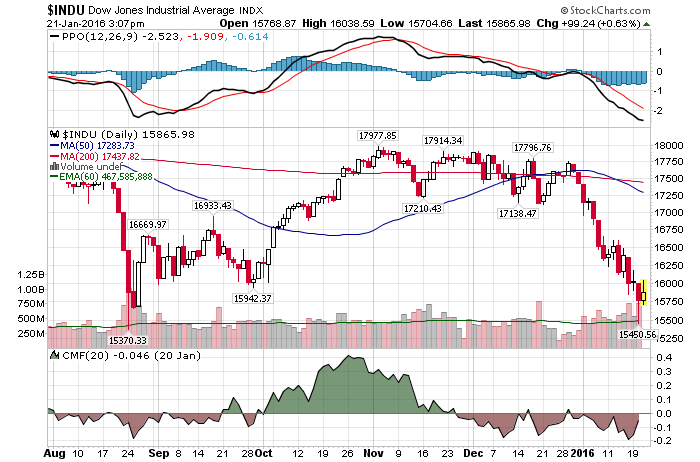

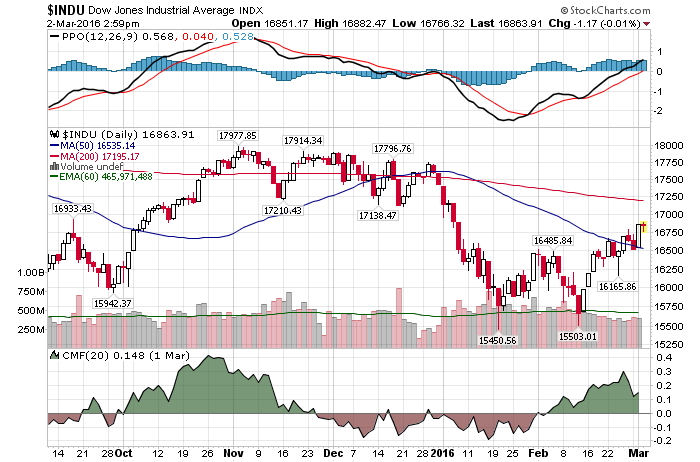

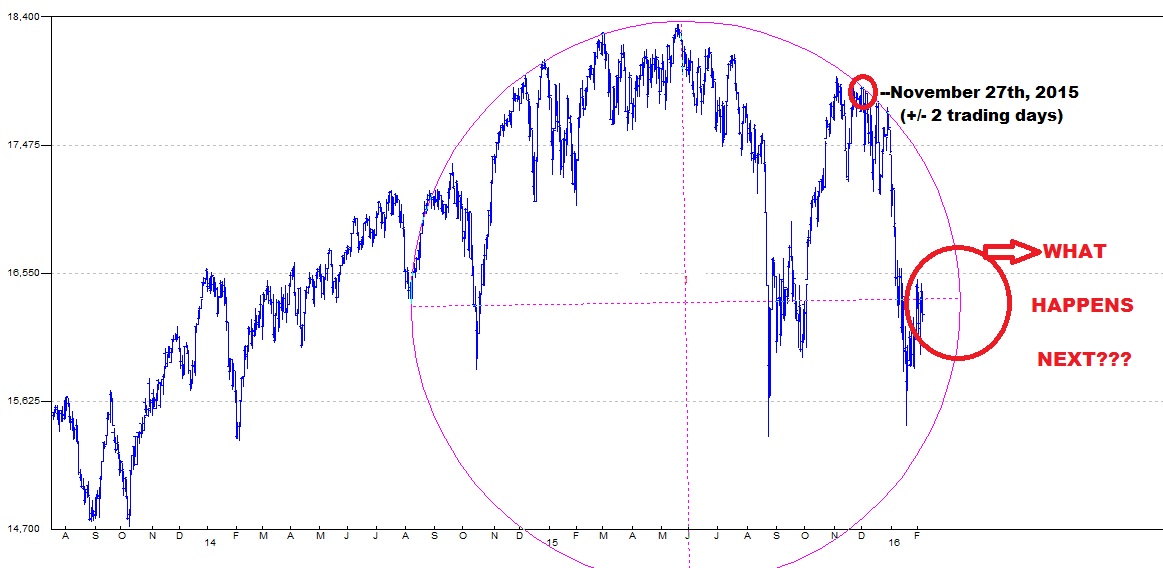

About 4 weeks ago I introduced the following chart to you. Suggesting in the process that the market will drive both bulls and bears up the wall over the next few weeks. And that is exactly what has been happening. Although, one can argue, at least for the time being, that bulls are winning the battle.

In reality, the market remains within the confines of a trading range or support/resistance levels outlined above. Further, the market will continue to trade within the said trading range until a certain date is reached in the future. When that happens, the market will stage a massive move. Either up or down.

If you would like to find out exactly when, in TIME, the structure above terminates. In addition to in which direction this larger move will develop, please Click Here.

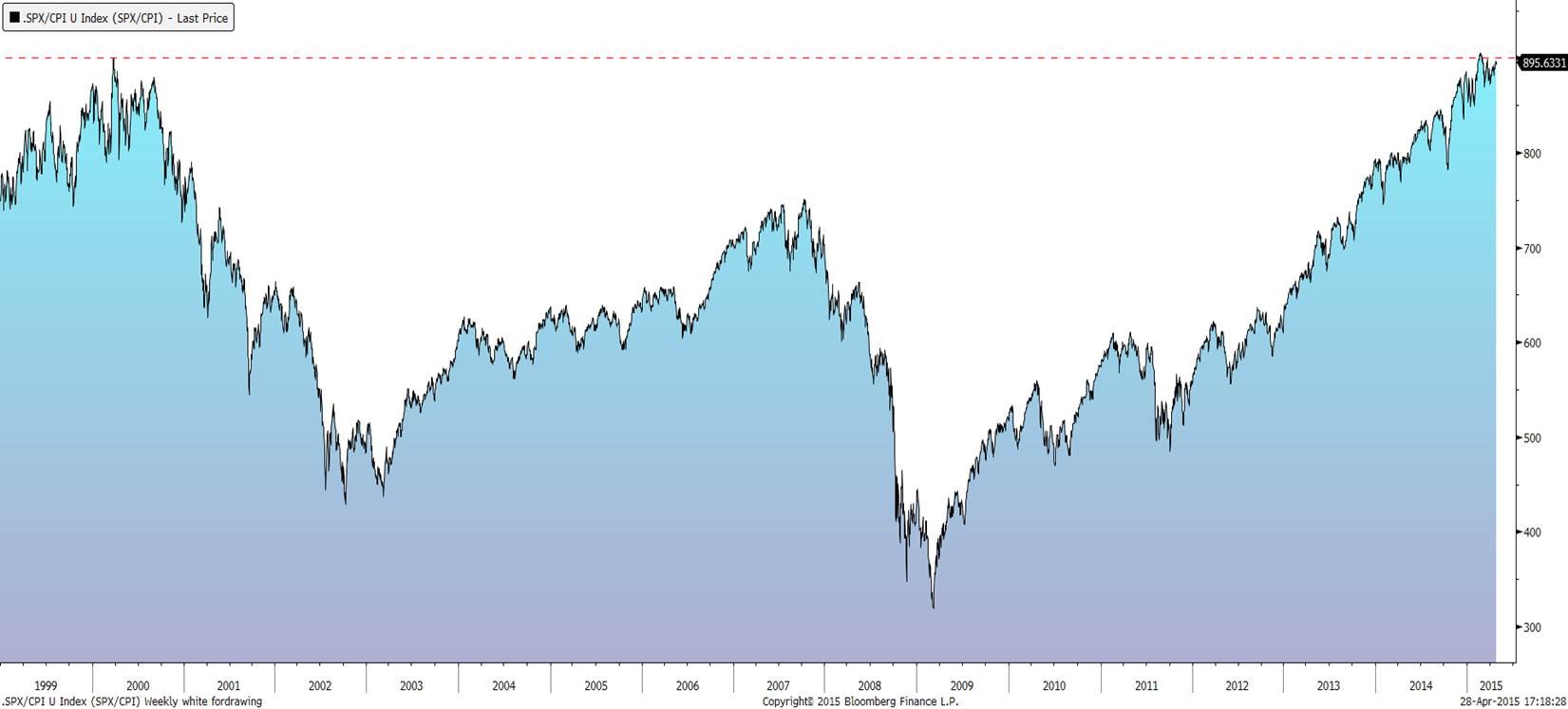

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. March 2nd, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!