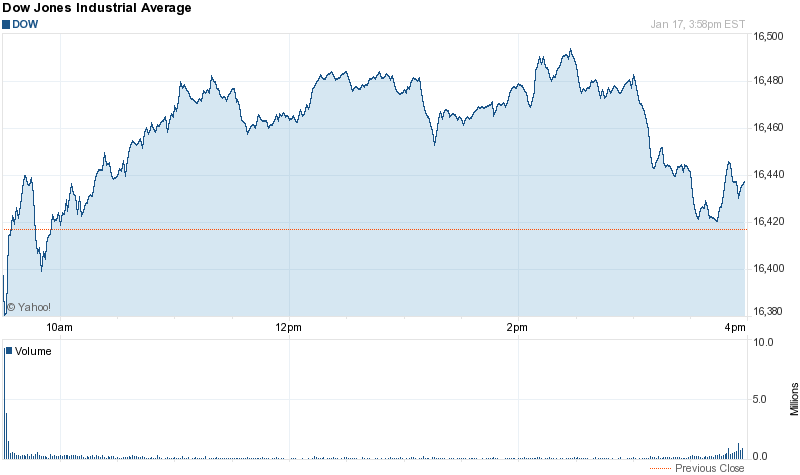

A strong up day with the Dow Jones up 181 points (1.11%) and the Nasdaq up 71 points (1.72%)

While most of today’s rally was caused by the FOMC Minutes, I give very little weight to such fundamental factors. As explained earlier on this blog, we believe most market participates do not have the correct fundamental macroeconomic framework or understanding associated with today’s market environment. Certainty not the cyclical market structure. In fact, we believe the market (particularly the Nasdaq) continues it’s bounce from an oversold position. When the bounce completes itself over the next few trading days, we would expect the market to XXXX.

Further, our mathematical and timing work continues to show that the bear market of 2014-2017 is just around the corner. When it starts, it should very quickly retrace most of the gains derived over the last two years (at least). Those who are positioned properly should be rewarded handsomely. If you would be interested in learning exactly when the bear market of 2014-2017 will start (to the day) and it’s subsequent internal composition, please Click Here.

(***Please Note: Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts here. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here).

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Click here to subscribe to my mailing list

Stock Market Update. April 9th, 2014. InvestWithAlex.com Google