Carl Giannone says he’s given up hunting for quality stocks. Now he’s simply riding the wave of upward momentum in the U.S. market. “It’s a game of musical chairs,” said Giannone, who manages an equities team at T3 Trading Group LLC in New York. “You just want to make sure you can sit down.”

The Federal Reserve’s near-zero interest rate turns five years old next month, the longest period without an increase in history. Coupled with more than $3 trillion of asset purchases, it adds up to “Bernankecare,” said Joshua Brown, chief executive officer of Ritholtz Wealth Management in New York. And it’s causing parts of the market to behave strangely. Stocks of companies with weak balance sheets are rising twice as fast as stronger ones; junk borrowers get rates lower than their investment-grade counterparts did before the credit crisis; and initial public offerings are doubling on their first day of trading.

While in the minority, some investors say prices have climbed so high it’s possible to look ahead and see an ugly end.Laurence Fink, chief executive officer of BlackRock Inc., the biggest U.S. money manager, said in an interview with Bloomberg Television on Nov. 12 that he feared a bubble and the Fed ought to quit buying so many securities.

Read The Rest Of The Article Here

Have you ever seen a real bull orgy? I haven’t, but a fathom it would be a fairly gross site to feast your eyes upon. Luckily for you can see an artificial one by turning on CNBC or reading any other kind of financial media. Bulls are salivating over each other, predicting the DOW at 20,000, 25K, 50K, to infinity and beyond. It’s quite entertaining to watch.

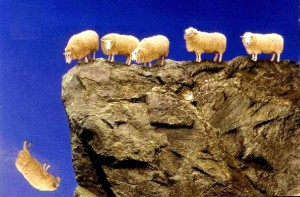

The article above is right on the money. At this stage everything is in the speculative bubble that will pop and it has become a game of musical chairs. However, that is not why I bring this up. I want to point your attention to a psychological breakdown of market participants. We all know the saying “Buy Low Sell High” or “Buy When There Is Blood On The Streets”, yet not a single person I know actually does it.

Case and point, March 2009 bottom. Not a single person I know, not on TV or elsewhere advocated buying. No, they were all talking about the end of the world, how low the market will go and what stocks to short best. The blood was running on the street, the stocks were being given away and these fools couldn’t see the forest through the trees. Now the situation is completely reversed. When everyone should be selling and/or going short, everyone is screaming BUY, BUY, BUY. It’s a fools game and if you buy today you are that fool. I guess human psychology, the primary driver behind the stock market, will never change.

With such a backdrop it is very nice to know exactly when the Bear leg of 2014-2017 will start and the damage it will do. While Bulls are busy having their orgy, the market is getting ready for a massive haircut. You have been warned.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

The U.S. stock market is killing it. In the two-and-a-half year period from Jan. 1, 2011, to June 28, 2013, U.S. shares returned a cumulative 35 percent—26 percentage points ahead of international developed markets and 47 points better than emerging markets.

The U.S. stock market is killing it. In the two-and-a-half year period from Jan. 1, 2011, to June 28, 2013, U.S. shares returned a cumulative 35 percent—26 percentage points ahead of international developed markets and 47 points better than emerging markets.