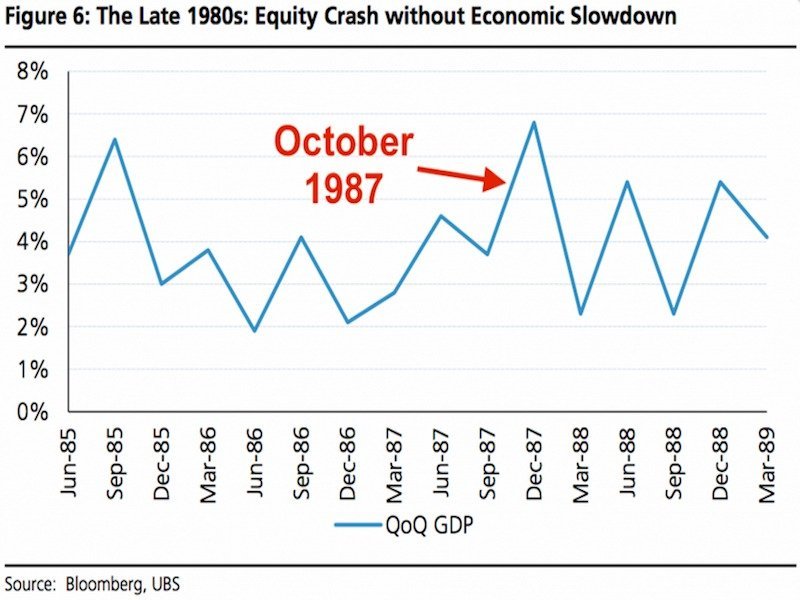

It has been exactly 28 years since the market really “crashed” in October of 1987. Well, if we don’t count Nasdaq’s 2000 “mini crash”. On that day in 1987, the Dow Jones Industrial Average plunged a gut-wrenching 508 points, or 22.6%.

But, here is what everyone forgets. At least according to this article. Everyone forgets the most important thing about the Black Monday stock market crash of 1987

- Stock market crashes don’t lead to recessions. The stock market follows GDP.

My Comment: Actually, it’s the opposite. It is the stock market that leads the economy/GDP, etc….. and not the other way around. And crashes do lead to recessions or worse. Just take a look at 1907 or 1929 or 1937 or 1946 or 1972 or 2000 or 2007. At all of those junctures the US Economy was booming. That abruptly changed when financial markets headed lower. At times in a violent fashion.

- They are great buying opportunities as stocks always recover.

My Comment: Long-term YES, but at certain junctures it takes time. A very long time. Plus, it depends on where we are in the cyclical composition of the market. The reason 1987 crash was recovered so fast was due to the fact that we were just starting a 1982-2000 bull market. On the flip side, the 1929 crash took over 20 years to recover. Well, 50 years of a flat inflation adjusted market if we go back to the termination of a previous bull market in 1899.

Is a crash possible in today’s FED controlled market?

Most people or professionals will argue that the answer is a clear NO. The FED has too much influence on what the market does. My answer is a most definite YES. For a very simple reason. When no one expects something to happen, it often does. Particularly, when it comes to financial markets.

Is Another Crash Possible In Today’s FED “Controlled” Market? Google