Weekly Update & Summary: March 8th, 2014

The market continued its bull move with the Dow Jones being up +108 points (0.67%) and the Nasdaq being up +28 points (0.65%) for the week. Structurally, the market left another gap at 16360 (in addition to the one last week at 16,100). Plus, there are a number of gaps going all the way down to 15,500. All of them are to be closed during the upcoming bear market leg.

Fundamental & Market Analysis:

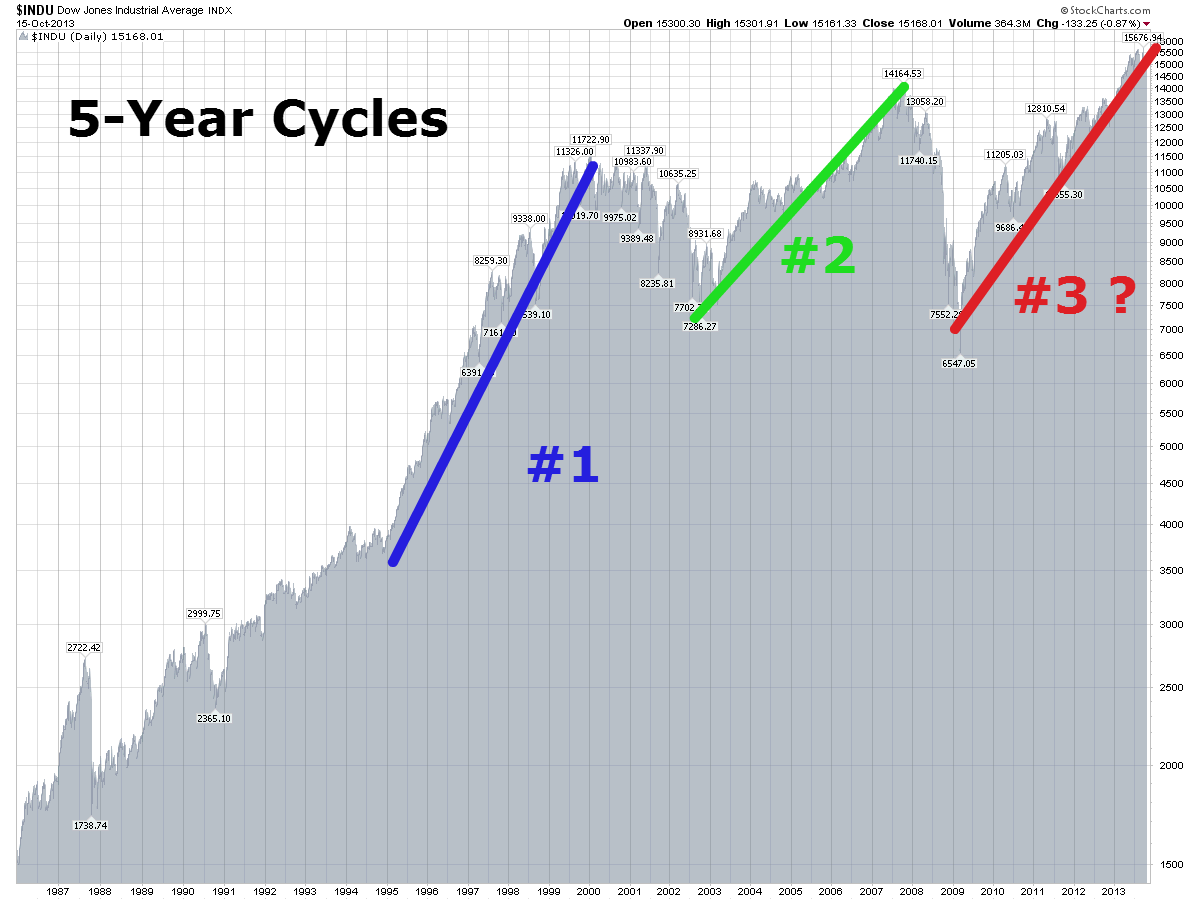

Last week we looked at the 17 year alternating Bull and Bear market cycles and why this Bear market that started in 2000 will complete itself only in 2017. Today, I would like to take a quick look at the 5-Year Cycle and the reason for today’s bull market.

Particularly, let’s take a look at the two most recent 5-Year Cycles and how they apply to today’s stock market.

#1: 5-YEAR CYCLE 1994 Bottom To 2000 Top.

This cycle started on December 9th, 1994 and completed on January 14th, 2000. During this time the stock market moved 8269 points in 1287 trading days. In calendar terms, the cycle took 5 Years and 36 Days to complete. We all know what happened afterwards.

#2: 5-YEAR CYCLES 2002 Bottom to 2007 Top

This cycle started on October 10th, 2002 and completed on October 11th, 2007. During this time the stock market moved 7098 points in 1259 trading days. In calendar terms, the cycle took 5 Years and 1 Day to complete. We all know what happened afterwards.

TODAY’S-5 YEAR CYCLE 2009 Bottom to 2014 Top ?

This cycle started on October 6th, 2009 and is scheduled to complete itself on XXXX. As of today, the stock market moved 10036 points in 1260 trading days. In calendar terms, we are exactly at 5 years. The questions here is as follows….

Are we currently developing the 5 cycle or are we in the cyclical bull market? If yes, when will this cycle top out and what’s next?

While I have the exact answer, unfortunately, that answer is available to my premium subscribers only. Please Click Here.

Now, the sample above is just two cycles. There are many more. Here are just a few from off the top of my head. 1924-1929, 1932-1937, 1961-1966, 1982-1987.

In summary, 5-Year cycle is an incredibly important cycle and represents one completed growth cycle within the stock market. When it completes, the market tends to shift gears and change trends. In some of my earlier forecasts I have suggested that the Dow topped out on December 31st, 2013 ushering in the bear market of 2014-2017. That should make it very clear what happens next. If you would be interested in an exact breakdown, please visit our Subscriber section.

Macroeconomic Analysis:

The situation in Ukraine continues to escalate.

With the US, the EU and Russia throwing out insults and threatening sanctions against each other, this situation might very well become the “fundamental” tipping point for the market as early as next week. Today, I would describe the situation as a tightrope balancing act. It might die down over the next couple of weeks, but it might also escalate to unimaginable level. Fast. Whatever happens, this is not a good sign for Russia/US relationship going forward.

It would be interesting to see if the point of force described in the Mathematical & Timing section below would be the same point where things between the US and Russia escalate further.

Technical Analysis:

The overall technical picture is clearing up.

Long-Term: The trend is still up. Market action in January-February could be viewed as a simple correction in an ongoing bull market.

Intermediary-Term: Since February 5th, intermediary term picture shifted from negative to positive. Giving us a technical indication that both the intermediary term and the long term trends are up. Yet, that in itself can be misleading as per our timing analysis discussion below.

Short-Term: Short-term trend has turned bullish as well.

While all 3 trends are bullish, this might be misleading. Please read our Mathematical and Timing Analysis to see what will transpire over the next few weeks.

Mathematical & Timing Analysis:

(*** Please Note: This time around about 90% of the information contained within this section has been deliberately removed as it contain too much technical information. Particularly, exact dates and prices of the upcoming turning points. As well as trading forecasts associated with them. I deem such information to be too valuable to be released onto the general public. As such, this information is only available to my premium subscribers. If you are a premium subscriber please Click Here to log in. If you would be interested in becoming a subscriber and gaining access to the most accurate forecasting service available anywhere, a forecasting service that gives you exact turning points in both price and time, please Click Here to learn more.Don’t forget, we have a risk free 14-day trial).

XXXX

Date Target: XXXX

Price Target: XXXX

XXXX

Hence, I suggest the following positioning over the next few days/weeks to minimize the risk while positioning yourself for a forecasted market action.

If You Are A Trader: XXXX

If No Position: XXXX

If Long: XXXX

If Short: XXXX

CONCLUSION:

An incredibly important week is coming up. Above, I have described the point of force, various possibilities and exactly what you should do in each case. With increased volatility, multiple interference patterns and an incredibly important long-term turning point we must be very careful and risk averse here. Those anticipating the moves and those who can time them properly will be rewarded appropriately.

Please Note: XXXX is available to our premium subscribers in our + Subscriber Section. It’s FREE to start.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Click here to subscribe to my mailing list

5-Year Market Cycles & Weekly Update. A Must Read. Trust Me. Google

3 Replies to “5-Year Market Cycles & Weekly Update. A Must Read. Trust Me.”

Comments are closed.