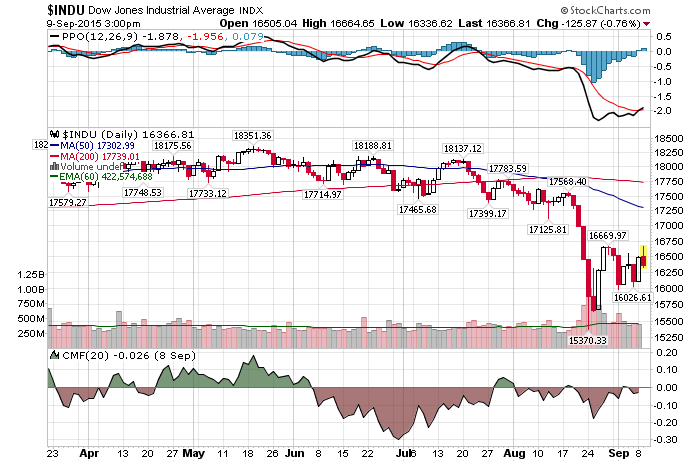

9/9/2015 – A down day with the Dow Jones down 237 points (-1.44%) and the Nasdaq down 55 points (-1.15%)

Today, most investors in the stock market subscribe to the “Buy The Dip” mentality. After all, it has worked for close to 7 years and there is no apparent need to change. Now, the same mentality is making an appearance in Silicon Valley.

Silicon Valley feels the aftershocks of Wall Street’s turbulence

“For venture capital investors, it’s a great opportunity to pick up some interesting assets on the startup side,” he said. “As an example, in 2008, 2009 downturn, we made investments in companies such as New Relic (NEWR), Zulily (ZU), T-Mobile (TMUS), all of whom have gone public and they were terrific investments for us, all made during the downturn.”

That sounds wonderful, but there is one big problem. Thus far, the Dow has corrected 16% off of its May 19th top. Between 2007-2009 the Dow declined 55%. Most of the high flying tech stocks and illiquid start-ups proceeded to collapse to the tune of 80-95% at the same time.

I am confused, did Uber’s valuation collapse over the last few weeks?

And since the answer is no, I continue to maintain my view. Mark Cuban is dead on in identifying Silicon Valley’s Tech Bubble 2.0: Why This Tech Bubble is Worse Than the Tech Bubble of 2000. At the end of the day, Silicon Valley has about as mush liquidity as California’s dried up reservoirs. Something that Angel investors, venture capitalists and stock option millionaires are about to find out.

How big is this bubble? Consider the following. Uber’s valuation went from $60 Million in 2011 to $50 Billion today(not a typo). They must be making a ton of money…..right?WRONG. Bloomberg estimates that Uber showed $470 million in operating losses with $415 million in revenue last year. Plus, the company was set a major legal blow in California by requiring their drivers to be classified as employees. And as far as I am concerned, it is just a matter of time before other states and countries regulate Uber out of business to protect taxi drivers.

In other words, the valuation above is not only outrageous, it is, how should I put it, retardedly outrageous.

Back to Mark Cuban. It is now evident that most market pundits out there are dismissing Mark’s view. And while Mark talks about Angel Investors and illiquidity in that market, his analysis can just as easily be applied to today’s stock market. More about that in a second.

First, here is what most people don’t realize about Mark Cuban. After selling his first business Mark became a heck of a trader and investor in the 1990’s. His returns were so good at the time that Goldman Sachs tried to bring him in order to figure out what he was doing. This same ability helped him unload Broadcast.com for $5.7 Billion to Yahoo right at the top of the tech bubble. Here is what he thinks.

I have absolutely not doubt in my mind that most of these individual Angels and crowd funders are currently under water in their investments. Absolutely none. I say most. The percentage could be higher. Why? Because there is ZERO liquidity for any of those investments. None. Zero. Zip.

So why is this bubble far worse than the tech bubble of 2000 ?

Because the only thing worse than a market with collapsing valuations is a market with no valuations and no liquidity. If stock in a company is worth what somebody will pay for it, what is the stock of a company worth when there is no place to sell it ?

We often talk about the stock market, but we rarely look at this side of the equation. Mark is absolutely right. If you are an Angel Investors, good luck getting your money out. Especially when today’s Silicon Valley’s bubble bursts. Plus, the chances of hitting a good exit in tech are about as good as winning a lottery.

What’s more, the bubble Mark Cuban has identified in the tech industry is the same bubble I see in the stock market. The drivers behind both are the same. The only difference is the amount of liquidity available.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. September 9th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Silicon Valley’s Illiquid Bubble Cracks Begin To Widen Google