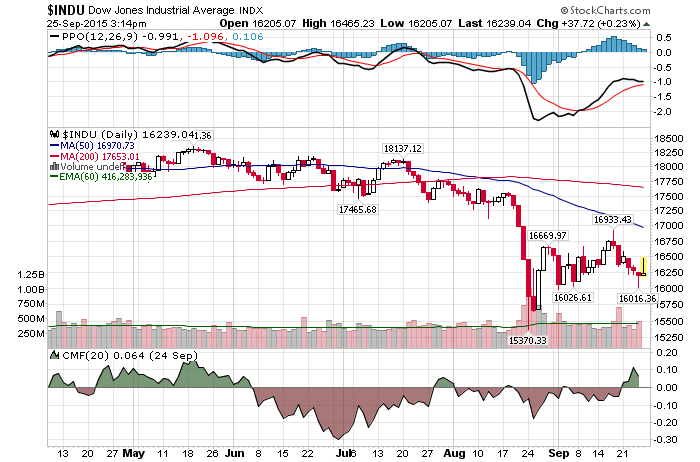

9/25/2015 – A mixed day with the Dow Jones up 112 points (+0.69%) and the Nasdaq down 48 points (-1.01%).

The market is confused at the present moment. There is no other way to put it. Confused about the direction, valuations, the FED, earnings, August’s sell-off, etc….. And while some see it as a buying opportunity of a lifetime and the Dow 20K by the end of the year, others see the early stages of a steep bear market.

My view is very well know here. So, instead of repeating it for the 100th time, let’s look at what some of the others are saying. People you should be listening to….

El-Erian sees ‘once a decade’ opportunity

“If you already have exposure, wait a little bit, there are going to be even more attractive positions—there are still people stuck in those markets looking to get out,” he said. “We’re going to look back on this, and this is going to be a very attractive stage.”

“It’s one of these things that happens once a decade … but be careful because it’s going to be incredibly volatile in the next few months,” he added.

My Comment: He is talking about MSCI Emerging Markets here and I couldn’t agree more. Russia, Brazil, etc… .are being given away when compared to the Western Valuations. I haven’t checked in a while but a few months ago the market cap of Google was larger than the market cap of Russia’s entire market. Such deep value should attract value investors. At the same time, the bottom in these indices are likely to occur at the same time the US Bottoms. Hence, a little bit more patience might be needed.

Shiller: Stocks and housing are overvalued– here’s what to do about it

“The correction in August brought the market down ten percent,” Shiller says. “But it’s halfway back up. It’s still looking pretty frothy.”

My Comment: We are at historic highs in almost all markets and a clear double top in housing. All thanks to the FED and their little liquidity/speculation party. But, all good things eventually come to an end. Sometimes in a violent fashion.

Bill Gross urges Fed to ‘get off zero and get off quick’ on rates

“Zero destroys existing business models such as life insurance company balance sheets and pension funds, which in turn are expected to use the proceeds to pay benefits for an aging boomer society,” Gross said. “These assumed liabilities were based on the assumption that a balanced portfolio of stocks and bonds would return 7-8 percent over the long term.”

My Comment: I couldn’t agree more with Bill Gross here, but I don’t think the FED will raise in any meaningful way anytime soon. As I have indicated here so many times before. They cannot, and therefore, they will not. The market might eventually do it for them, but that’s a different story.

Finally, another frank opinion from Carl Icahn. If you participate in financial markets the video below is a must watch.

Carl Icahn and Larry Fink, BlackRock Chairman and CEO discuss the state of today’s financial market. As a quick summary…..

Carl Icahn: High-yield market is about to blow up (he indicated previously that he has a large short position there or building one). Just as it did in 2007-2009. This will have a net negative impact on the stock market. Just as it did in 2008.

Larry Fink: No way in hell, we don’t have the leverage we had in 2007.

My Comments: I believe Carl Icahn is on the right side of the trade here. The massive amount of leverage Larry Fink dismisses is still there. Its just that a large chunk of it got shifted onto the FED’s balance sheet and the stock market.

Here is what I believe the trigger point will be: As soon as investors lose “net faith” in the FED you will see this whole thing fall apart. Fast. As far as I am concerned they have already lost the window of opportunity to raise interest rates. They will now be stuck in the worst case scenario…..zero interest rates, no way to stimulate as another round of QE can backfire and collapsing capital markets. As soon as investors come to this realization, the jig will be up. And that should happen much sooner than most people anticipate.

Anyway, watch this video. It is definitely worth 5 minutes of your time.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. September 24th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Shocking Prediction: Here Is What Top Minds In Finance See Happening Next Google