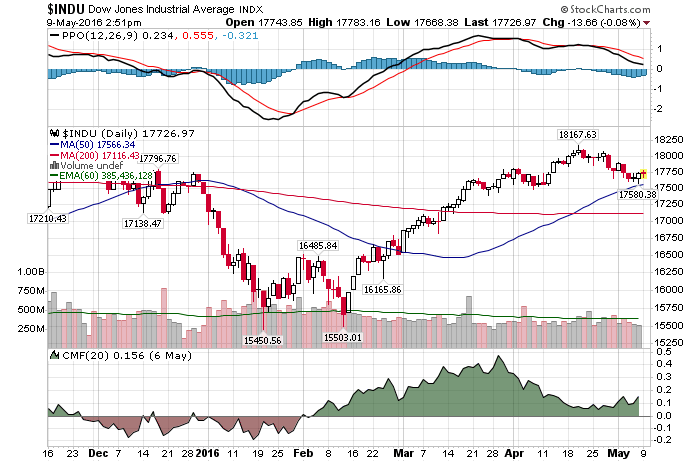

5/9/2016 – A mixed day with the Dow Jones down 34 points (-0.19%) and the Nasdaq up 14 points (+0.30%)

We have talked extensively about how overvalued the overall stock market is, how the FED is out of time/tools and where we are in the overall cyclical composition of the market. Here are just a few more things to worry about.

The video below talks about the USDJPY, flattening yield curve, seasonal factors, oil, gold, tech and financials. Overall it is a very good overview of where we are and what to expect going forward.

But that’s not the end of it. On Friday the weekly 100MA has crossed over the weekly 50MA. That has happened only twice in the last 20 years and in each instance “carnage followed”.![]()

Finally, commercials (smart money) have now built a massive long VIX position. But hey, who am I to tell you not to go long here. Quite a few market pundits suggest the Dow might see 20K and beyond by year’s end. If you would like to find out if that would be the case -OR- to the contrary, 12K, please Click Here.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 9th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!