8/17/2015 – A positive day with the Dow Jones up 68 points (+0.39%) and the Nasdaq up 43 points (+0.86%)

Sometimes you just have to throw your hands up in the air and say…”What”? Paul Krugman believes that Chinese officials are ill equipped to run a proper Ponzi Scheme. Yet, the FED is doing it perfectly. Bungling Beijing’s Stock Markets

The New York Times’ Paul Krugman wrote today about increased concerns that the crony capitalists who run the Chinese economy simply don’t know what they’re doing. “Their zigzagging policies over the past few months have been worrying,” he noted, asking “i]s it possible that after all these years Beijing still doesn’t get how this ‘markets’ thing works?”

Apparently, the answer is “yes,” as he demonstrates that the government fundamentally misunderstands basics like the ratio of consumption to production. It attempted to float its economy through infrastructure spending — a sound idea — but did so “by funneling cheap credit to state-owned enterprises,” resulting in them taking on debt — which isn’t quite so sound an idea.

Fair enough. And how is this different from the FED funneling cheap credit to the US Corporations. Companies that should have failed in 2008/2009. And then flooding our entire financial system with massive amount of liquidity that went towards malinvestment and share buybacks. I don’t get it. He goes on…

Next, China adopted an official policy of boosting stock prices, combining a stock-buying propaganda campaign with relaxed margin requirements, making it easier to buy stocks with borrowed money. The goal may have been to help out those state-owned enterprises, which could pay down debt by selling stock. But the consequence was an obvious bubble, which began deflating earlier this year.

Again, Mr. Krugman, how is this different from what the FED did? Zero interest rates for over 6 years now and over $1 Trillion in QE. That led directly to share buybacks, speculation and the stock market bubble that we are witnessing today. Finally……

If they really don’t (know what they are doing), that’s a big concern. China is an economic superpower — not quite as super as the United States or the European Union, yet, but big enough to matter a lot. And it’s facing tough times. So if its leadership is really as clueless as it has been looking lately, that bodes ill, not just for China, but for the world as a whole.

At least something we can agree on. The whole world is following the same playbook. Juice the stock market and the economy NOW, worry about it later or when things begin to blow up. Well, it appears they are beginning to blow up. In China first, then here. And indeed, that bodes ill for the world as a whole.

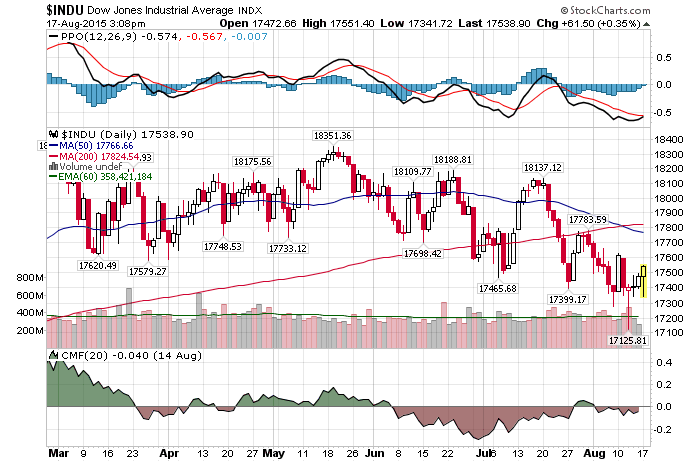

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. August 14th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Paul Krugman: Slams China’s, Praises America’s Ponzi Finance Google