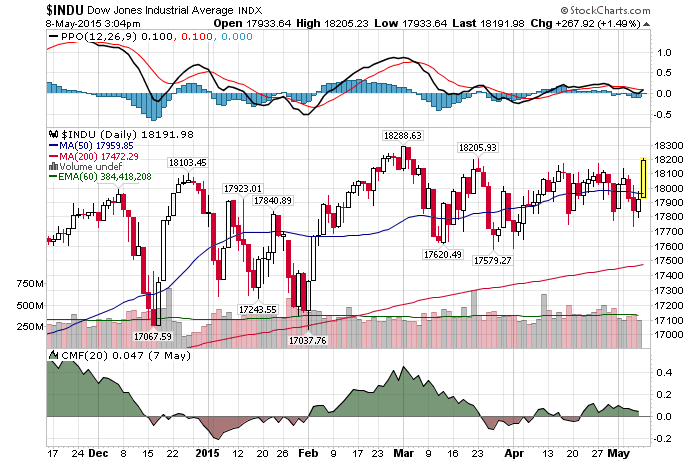

5/8/2015 – A positive day with the Dow Jones up 266 points (+1.49%) and the Nasdaq up 58 points (+1.17%).

The jobs number missed its expectation? Sell, sell, sell. Wait! What? It’s ideal enough for the FED to pause their proposed interest rate hikes? Buy, Buy, Buy!!! That about summarizes today’s market action. And if you had any doubts that this market is purely FED/Liquidity driven, well, they should be gone by now.

A few important things to get through before the weekend.

First, quite an honest look from Bill Gross of where we are today, what is causing today’s asset valuation bubbles and what the eventual outcome will be. Bill Gross: Central Banks Are Gaming Asset Prices Definitely worth a look. To summarize, we are now in two massive bubbles, stocks and bonds, driven by the FED and their obsession with higher asset prices. To perpetuate the myth of strong economic recovery. It now becomes a matter of time before all of this ends very badly. I cold-heartedly agree.

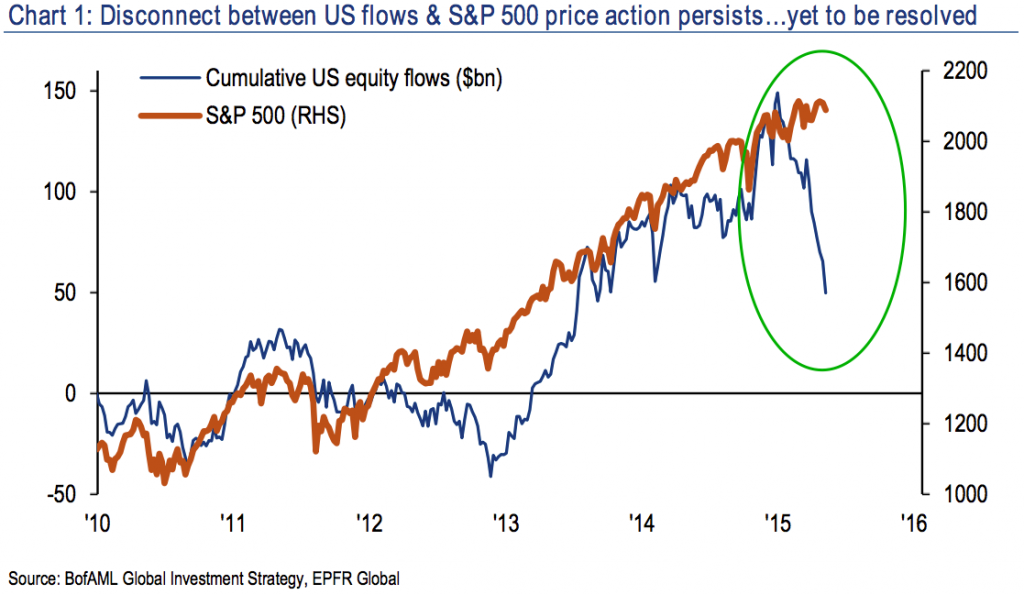

Second, macro economic data continues to collapse and equity outflows accelerate as the stock market remains near all time highs. Divergences galore. The disconnect in the US stock market just keeps getting bigger. The charts below should send a chill down your spine.

Finally, Larry Summers is concerned the US Economy will fall back into a recessionary mode. Larry Summers: I’m Concerned US Growth Won’t Pick Up

I have held a view that the US Economy will start rolling over into an all out recession by the 4th quarter of 2014. We have been witnessing exactly that over the last few months. This is rather simple. The entire US Economic recovery, over the last few years, has been driven by QE, zero interest rates and asset price speculation.

Take that away and we would already be in a severe recession. Further, now that these “prosperity drivers” are withering away, there is absolutely nothing to drive this economy forward. I have already covered the fact that we won’t see CAPEX growth going forward and I am having a really hard time imagining what can push us forward. Considering today’s valuation levels, this will indeed end very badly.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 8th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!