Just imagine for a second that your plane is cruising at 30,000 ft, or in the case of the Dow at 18,000 ft, when one of its engines suddenly blows. Let’s call that engine “zero interest rates and QE”. Not a big deal. Most planes will land without a problem with just one of its engines being operational.

But, what happens when the other one blows. Well, it’s a long way down. Buybacks no longer work to boost stock prices.

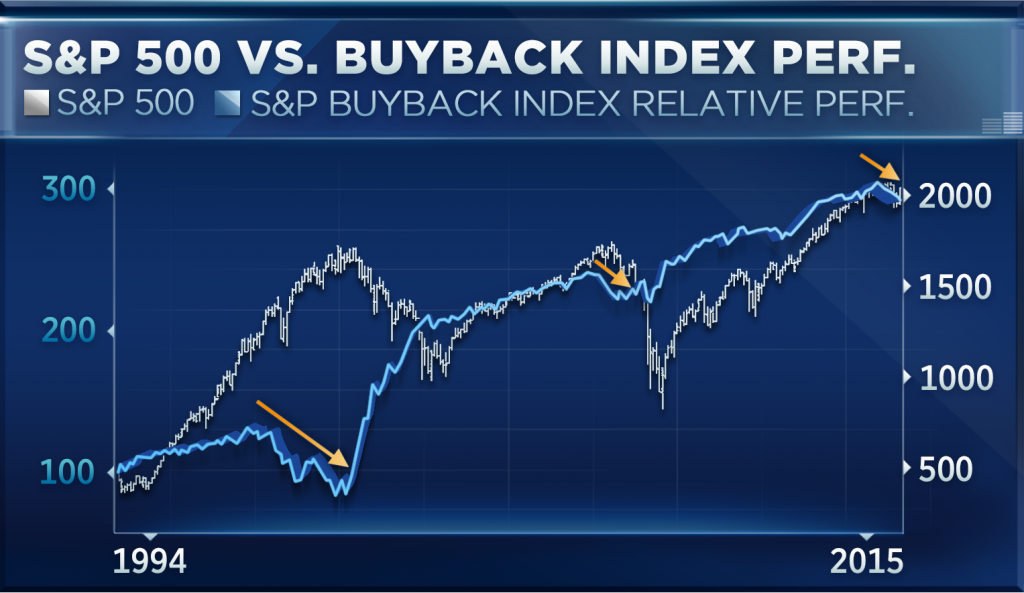

Stocks with big buyback programs are struggling this year, and according to one technician, a similar lag has previously preceded two market crashes.

As was mentioned here before, when it comes to the stock market and buybacks, Corporates tend to behave in the same fashion as most individual investors. They buy at the top and sell at the bottom.

Sure, it is easy enough to borrow at zero interest rates and then use that money to purchase stocks. Artificially driving up the prices. But there is another ominous sign to watch for. Credit spreads. Should credit spreads continue to widen, as has been the case lately, our proverbial second engine might blow too. If it hasn’t already.

That is to say, the stock market finds itself in an incredibly vulnerable place. At dizzying valuation heights and with no fuel/engines left to support its flight. I doesn’t take a genius to figure out what happens next.

What You Ought To Know About Stock Buybacks Slowing Down Google