Well, this is shocking. NOT. Things continue to develop just as was predicted here over two years ago. I am not sure how/why Harvard trained economists are “shocked” while others on Wall Street can see this coming from a mile away.

U.S. job growth cools in last two months, raising doubts on economy

At 142K the was a total disaster, 60K below the consensus and below the lowest estimate. Just as bad, the August print was also revised far lower from 173K to 136K.

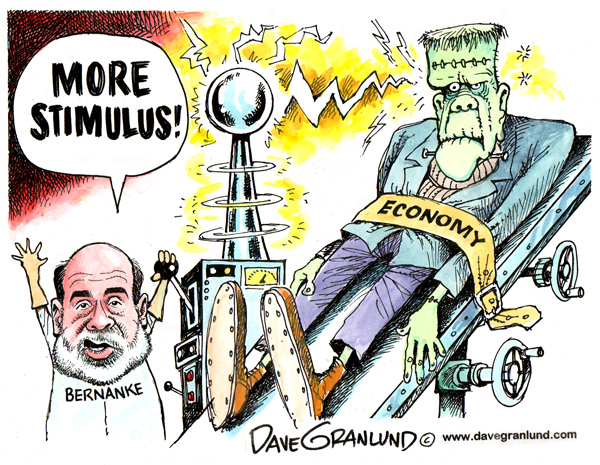

Allow me to explain this so even a Harvard educated economist and/or a two year old can understand. The economic recovery we have experienced since 2009 bottom has been caused by a massive infusion of credit through zero interest rates and QE 1-3. That’s it. It is equivalent to injecting a dying patient with a fatal dose of morphine, cocaine and meth. And while that will undoubtedly feel good for a little while (not that I would know), the end result is a forgone conclusion.

Anyone who thinks the FED will raise interest rates now is kidding themselves. I am sticking to my opinion expressed here Why The FED Will Not Raise Interest Rates

What happens next?

This is rather simple. The US Economy is coming to a screeching halt. Mostly due to the fact that zero interest rates and QE have now worked their way through the system. Throw in the facts that Shillers Adjusted P/E is at a 3rd highest level in history, the FED is stuck in the worst possible situation (unable to raise or stimulate further), earnings are expected to collapse, etc…… and we potentially have a powder keg situation on our hands.

Or, as I like to put it, a 40ft container full of TNT, with a lit fuse disappearing inside of it.

Jobs Disaster Confirms: No Rate Hikes Google