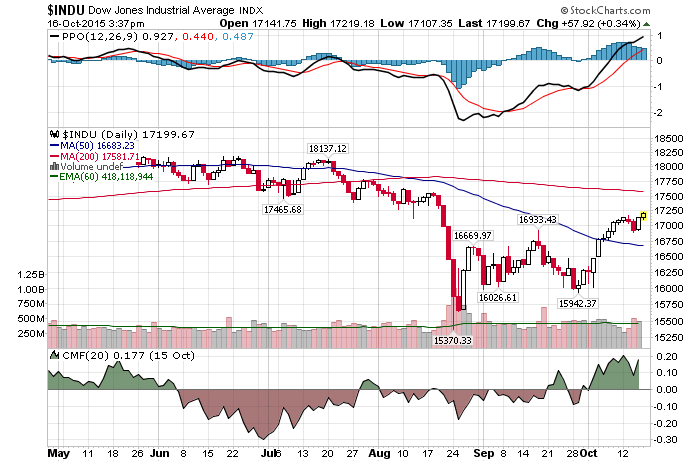

10/16/2015 – A positive day with the Dow Jones up 74 points (+0.43%) and the Nasdaq up 16 points (+0.34%)

Despite this week’s drama and high octane sell-offs and rallies, the overall market was able to push only marginally higher. Although, I must say, the sentiment is definitely bullish.

A few things to consider as we move into the weekend.

As my earlier posts throughout the week indicated, most corporates are missing their earnings targets and/or guiding lower. And while we already talked about WalMart, here is what the Netflix had to say Netflix blames weak U.S subscriber adds on new chip-based cards

“It’s just the dumbest thing I’ve heard,” Wedbush Securities analyst Michael Pachter said. “It begs a million questions,” he said.

I couldn’t agree more. I wonder how many companies will use this innovative excuse going forward. Yet, my view remains the same.

The reality is a little bit different. I think a high percentage of companies will guide lower or miss earnings. Now that that the QE and zero interest rates have worked their way though our financial system, the US Economy is rolling over into a severe recession. And there is nothing anyone can do to stop it. Given today’s overvaluation levels, that is not a good sign for the overall stock market.

But hey, what do I know….Bill Miller: Now is perfect time to buy US stocks

“But we also want people to take money out of stocks because they hate them, so they’re cheap,” he said in a ” Squawk Box ” interview. “That’s exactly the environment we have today.”

I especially love it when they all laugh at 1% treasury yields, followed by an always convenient, “Where else are you going to put your money?”

What these Bozos don’t get, as both Carl Icahn and I have outlined a number of times before……it is a hell of a lot better to earn 1% than to take a 30-50% haircut on your capital. Just as people found out 2000-2002 and then again in 2007-2009.

On the flip side, consider the following

- Why it may be time to cut your losses on the S&P 500

-

‘Bear claw’ will strike the market again: Yamada

For Yamada, it’s only a matter of time before the S&P 500 hits the next level of resistance, and investors should be prepared for what could be the start of sharp selling. “A lot of these rallies tend to bring us to a place of complacency before the bear claw may come out again to strike,” she warned. “We are skeptical of this rally.”

Who is right?

No one and everyone. That’s what makes the market. Yet, the fundamentals are fairly clear. The stock market, based on Shillers Adjusted S&P P/E Ratio, is at the 3rd highest valuation level in history. Right behind 1929 and 2000. At the same time and as evident from Q-3 reports thus far, earnings are decelerating if not outright collapsing. So is the US Economy.

Can the stock market stay up and/or push higher? Do you believe in magic…..would be a more appropriate question.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. October 16th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!