The saga of Herbalife (HLF) is very well known by now. On one side you have Bill Ackman, the founder and CEO of Pershing Square Capital Management LP. He believes the company is one giant Ponzi Scheme and he is trying to short the life out of this stock. On the flip side, titans such as Soros and Icahn are adding to their positions. Soros Boosts Herbalife Stake After Shares Fall

So, who is right and which way will the stock break?

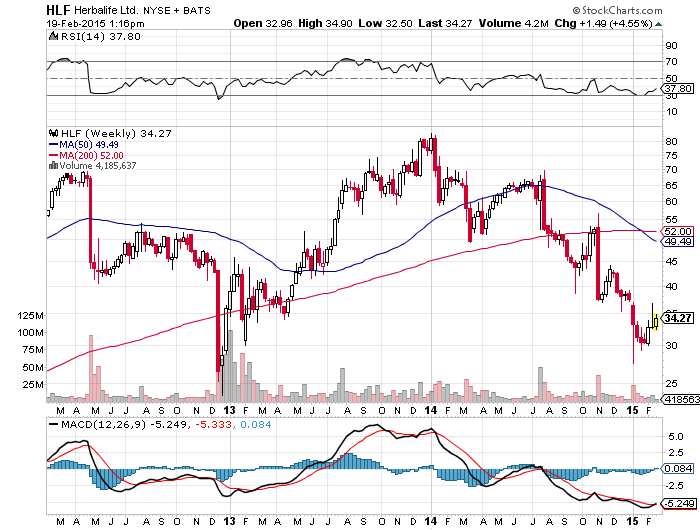

There are many pros and cons when it comes to fundamental analysis of Herbalife. Their general undervaluation, their accounting practices, high % of shares shorted, etc…. I will refrain from going into an in-depth fundamental analysis in this short outlook. A simple technical overview should suffice.

I believe Herbalife (HLF) should be on your LONG to watch list. It appears the stock is trying to bottom. We are near a major support level, the stock is undervalued and there is high short interest (45% of float). If the stock is able to establish a proper bullish reversal base here and then break above $40 a share, we might see a rapid subsequent move higher. Plus, it helps to have Soros and Icahn on the same side of the trade.

Is It Time To Buy Herbalife (HLF)? The Saga Of Giant D#$*s Google

One Reply to “Is It Time To Buy Herbalife (HLF)? The Saga Of Giant D#$*s”

Comments are closed.