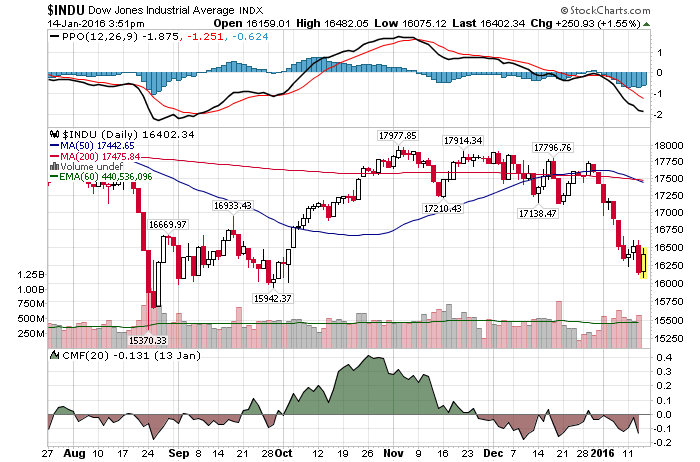

1/14/2016 – A positive day with the Dow Jones up 226 points (+1.40%) and the Nasdaq up 89 points (+1.97%).

Open any financial media outlet today and you will see doom and gloom. Here is just a small sample.

- Are These the Death Throes of the Seven-Year Bull Market?

- The S&P 500 could go to 1,600: Merrill strategist

- Analyst: Here Comes the Biggest Stock Market Crash in a Generation

And they don’t come much more bearish than Albert Edwards, strategist at Société Générale. He’s not had much nice to say about the global economy in years, and recent events have only hardened his convictions that the world is headed for disaster, and will take the prices of equities down with it. How much? Edwards predicts the U.S. stock market could plunge as much as 75%. That would be worse than during the financial crisis, in which stocks from their peak to trough dropped a brutal 62%.

My goodness, and people say that I am bearish.

First, let’s address the long-term picture. While a 75% drop might appear fundamentally feasible, it is not going to happen. Analysts must understand where we are in the cyclical composition of the market. The sell-off that we had between 2007-2009 was the worst of it. It is called a mid-cycle panic for a reason. It is identical to 1907-1909, 1937 and 1972-1974 sell-offs. In other words, we will not see such steep sell-off going forward or anytime soon.

Short-term, the market is lingering in an extremely oversold territory. As we have discussed earlier in the week. Everyone Expects A Bounce. Will We Get One?

And while it is reasonable to assume that some sort of a bounce is coming, the question is, how far will it go? Opinions differ here as well.

- History says this 6-year-old bull market is only getting started

- Goldman Sees 11% Upside in S&P 500 After an `Emotional’ Selloff

“What is happening is really very much an emotional response,” Cohen told Elliot Gotkine on Bloomberg Television. “We need to put things into perspective. Stocks are probably the best place to be.”

I wouldn’t necessarily classify this as an Emotional Sell-Off, but hey, what do I know. I will simply point out the following. Despite today’s oversold conditions, most investors continue to believe that we are still in a bull market. A bull market that has quite a few years to run. Not only that, the “Buy the Dip” mentality remains very well entrenched. Finally and despite the recent sell-off, most people are not at all concerned with the Dow at lower 16,000.

What does all of that mean?

While we will certainly get powerful bounces along the way, most investors continue deny the possibility of a full fledged bear market. That is to say, a possible bear market might be just getting warmed up here and no one is yet aware of the fact.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update.January 15th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!