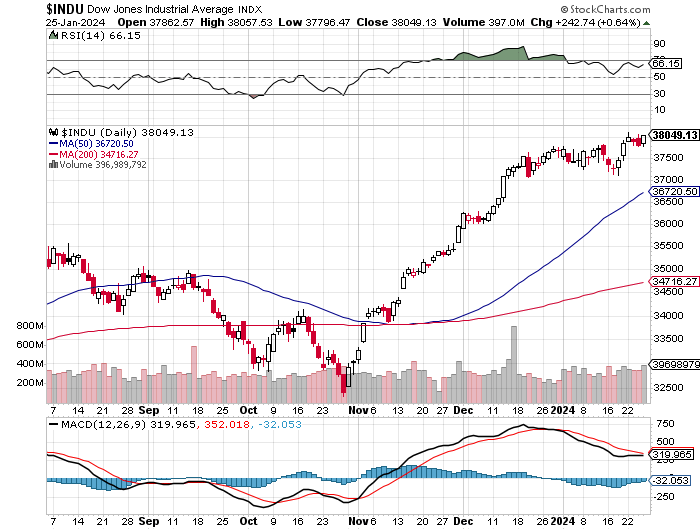

1/25/2024 – A positive day with the Dow Jones up 242 points (+0.64%) and the Nasdaq up 28 points (+0.18%)

The stock market continues to behave exactly as anticipated/projected.

The following data point caught my eye.

China’s Plunge-Protection Team Buys Billions In ETFs To Halt Market Rout

-

- “The national team is likely stepping to stabilize the market as they have done in previous market crashes,” said Marvin Chen, a strategist at Bloomberg Intelligence.

- And as Beijing bought, foreign investors were again aggressive sellers of mainland stocks after they dumped 13 billion yuan ($1.8 billion) worth of shares in the previous session, the most in more than a year.

- Meanwhile, the Hang Seng China Enterprises Index finished the day 0.8% higher, reversing an earlier decline of 0.6%. Down 10% this year, the HSCEI gauge is the world’s worst-performing major index. As for the CSI 1000, it was the familiar diagonal “PPT is here” line as Beijing didn’t leave any doubt about its presence.

I found it interesting because according to our mathematical time and price calculations Shanghai SE is about to bottom and stage a powerful rally. We wrote about it a little while ago.

Our mathematical and timing analysis for Shanghai Stock Exchange (SSE) shows the following……

-

- SSE is currently moving into its mid-cycle bottom scheduled to arrive on XXXX.

- Our mathematical calculations suggest the bottom will arrive around XXXX (+/- 50 points)

- Once the bottom is put in place SSE should rally into its next mid cycle top, scheduled to arrive in 2025.

- Our calculations suggest SSE will run up to at least XXXX by 2025.

In summary, Shanghai Stock Exchange is bottoming very soon. Once the bottom is put in place SSE should rally into a mid-cycle top by XXXX of 2025. A long-term double top formation at that juncture is likely.

If you would like to see our exact Time/Price targets for Shanghai SE, please Click Here