10/12/2015 – A positive day with the Dow Jones up 48 points (+0.28%) and the Nasdaq up 8 points (+0.17%)

That depends on whom you ask. As far as I can tell there are two primary views out there. First, the stock market just had a correction, not that dissimilar to what had happened in 2011, and we are now primed to go higher. Much higher, as a secular bull market is just getting started.

The other side of the coin suggests that the market is now shifting into what could be a massive leg down. That entails the market is not yet done with a secular bear market that started in 2000.

Who is right?

That is exactly what this very important article discusses The Stock Market Is Poised for a Huge Selloff — Don’t Be Fooled by the Recent Rally

Let’s take a closer look. My comments are in green, but I encourage you to read it in full.

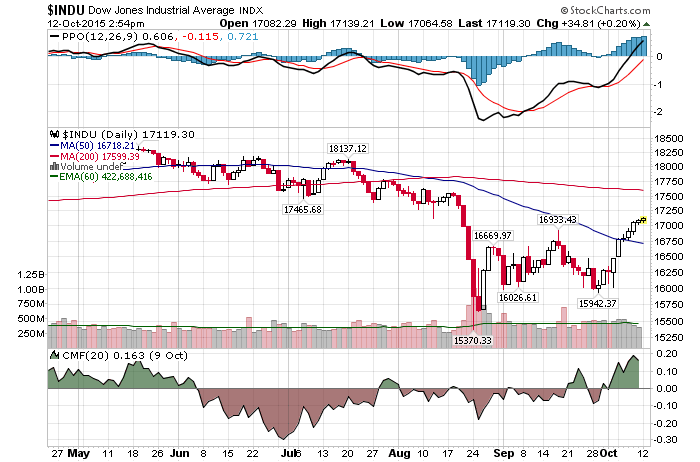

1. History tells us that 5%-8% rallies in five to eight days, like the one we’ve just seen, are about three times more common during bear markets.

Exactly. These moves are designed to deliver the maximum amount of pain to the shorts, while bulls tend to declare a reversal and a “new” bull market.

2. The sharpest rises on record are often bear bounces to lower highs, which define a bear market: lower highs and lower lows!

This has been the case thus far.

3. Bull markets take money from bears and give it to bulls, while bear markets take money from bulls and bears.

How true. It is incredibly hard to pass through these monster short-covering rallies and/or bounces. Most shorts can’t handle it and get out right at the bounce top. That is why most investors would be better off with a longer-term short approach.

4. Bulls markets begin slowly, with melt-ups coming in the middle, as investors seek pleasure from prices that have already been rising. The final rally comes on weaker breadth, lighter volume and waning momentum, as cash and margin are already fully deployed, and the crowd assumes it’s different this time, continuing to buy without regard for potential pain.

That was, indeed, the case in the first half of 2015.

5. Bear markets end in meltdowns, as investors attempt to avoid pain from prices that have already been falling. The final crash arrives after the meltdown is nearly over, as some news items arrive that the selling can be blamed upon.

Very true. Either that or a very long base building process. With that in mind, consider August 24th bottom. It was far from a typical wash out “bottom”. First, it was untradable. Second, most bulls didn’t even care or pay attention.

6. When the market struggles to reach back above previously broken 50- and/or 200- day moving averages, that’s a warning of exhaustion.

Indeed.

7. Bulls markets create arrogance. Novice investors believe they are smarter than industry professionals. Retail investors generally buy stocks they know and like if those stocks are already rising, betting that there will always be a “greater fool” willing to pay an even higher price later.

I always operate under the presumption that I am dumbest guy in the room.

8. Bear markets create evidence that professionals are no smarter than novices.

Unless they timed the exact top and held short for the duration of a bear market.

That is to say, while Citigroup is telling their clients to be “Brave” and buy stocks here, today’s valuation levels and historic market patterns are still flashing a red light. And instead of going long, investors might consider the possibility of a strong sell-off in the near future.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. October 9th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!