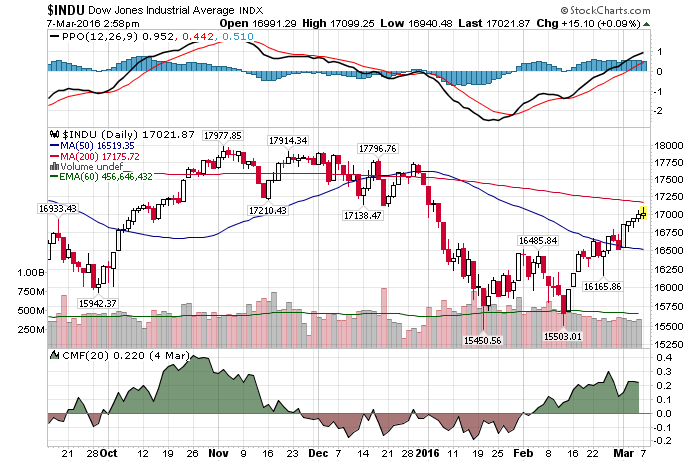

3/7/2016 – A mixed day with the Dow Jones up 66 points (+0.39%) and the Nasdaq down 9 points (-0.19%)

I had to shake my head in disbelief so many times over the weekend, I think might have sprained my neck. To save you the trouble, here is the best of it……

“I can say, China’s economy will absolutely not have a hard landing,” Xu said. “The so-called predictions for a hard landing will definitely come to nothing. Please rest assured, this possibility does not exist.”

Famous last words? You bet. If you should have learned anything from this blog over the last few years it’s the following. When top officials go out of their way to issue such a statement, the exact opposite is true. That is to say, run…..don’t walk away from China.

Finland and the Netherlandshave already shown their interest in giving people a regular monthly allowance regardless of working status, and now Ontario, Canada is onboard. The premise: send people monthly checks to cover living expenses such as food, transportation, clothing, and utilities — no questions asked.

Eh? Hey, why the hell not. While at it, why not go out with a bang Canada. Forget about covering monthly expenses. I think everyone should get a Ferrari and a $1 Million allowance. I am amazed at the fact that politicians do not understand simple math, let alone basic economic principals.

It’s the best time to buy bullish options on the Standard & Poor’s 500 Index in 20 years, Goldman Sachs Group Inc. says. The U.S. benchmark has a 21 percent probability of rising 5 percent in the next month, according to a model by the New York bank that looks at free-cash-flow yield, return on equity, Institute for Supply Management data and capacity utilization. The options market is pricing in only a 5 percent chance the S&P 500 will move as much.

Yep, it is as simple as that. Load up on call options and make a fortune. I am just wondering who would be stupid enough to write the above calls. Oh wait ?!?!

But not everyone is as optimistic…….

“To highlight that, in my view, stocks’ counter-trend bounce off the February lows has now run its course and I believe we are – in early March – likely to see the onset of the next leg weaker in risk, vs stronger in core duration,” Janjuah wrote in a note Friday. “I expect this next leg of weakness to last three to five weeks and to result in new lows so far in this cycle in stocks (S&P500 into the 1700s) and new lows in core government bond yields (target 1.5% in 10yr USTs).”

That sounds about right…..

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. March 7th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!