Well, it is a lot easier said than done. Recently Bill Ackman acknowledged that he should have lightened up on his long exposure at the top.

The first place to look for an explanation is mistakes we made in 2015, and we did make some important mistakes. Principally, we missed the opportunity to trim or sell outright certain positions that approached our estimate of intrinsic value. Our biggest valuation error was assigning too much value to the so-called “platform value” in certain of our holdings.

Let’s consider the overall market for a second in reference to what Mr. Ackman is talking about.

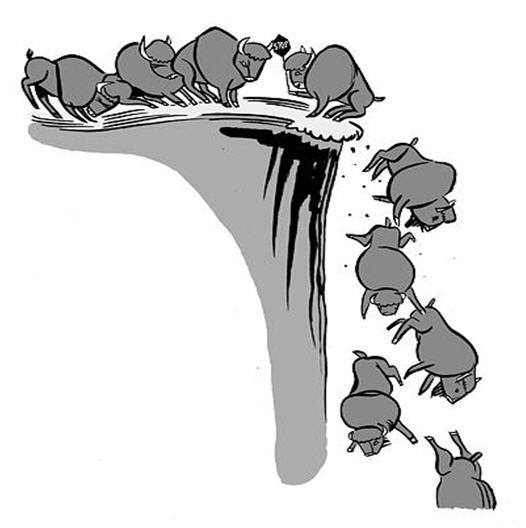

There are two forces at play here. Greed and fear. Well, they are technically one and the same. Sell too early and you will be labeled a fool. Consider the fact that the majority of analysts and market pundits were calling for an all out “Blow Off Top” as recently as end of December. Never mind last May or July highs.

To sell at the top or buy at the bottom a better tool set is needed. That tool set is TIMING. If the cyclical long-term timing framework is known, it is a lot easier to make that decision. For instance, I outlined a number of these cycles in my weekly update Shocking: The Real Reason Behind January Sell-Off & What Happens Next

When you know that an important top or bottom is about to arrive, you no longer have to second guess yourself. Simply sell and/or go short, while the rest of the investment world awaits a blow off top that is unlikely to arrive. If you would be interested in that kind of an analysis, please Click Here

Here is how TIMING works: Markets being, at minimum, a three-dimensional phenomena, exactly like a large molecule rotating in space, in and out of Z plane, with DNA coding sequences governing the entire process. Without understanding the market is 3-D, twisting like a plant governed by the phyllotactic laws of dual number series and harmonic composition and decomposition, all measurements taken on a 2-D chart become misleading. – Dr. B